Source: -

Source: -

Source: -

Source: -

No about page exists.

What has changed?

The updated module includes asset-level reporting guidelines and a set of sustainability reporting disclosures complemented by required and recommended ESG KPIs. These are cross referenced in the Sustainability module. The ESG KPIs will be incorporated in the 2023 update of the INREV SDDS.

When it becomes effective?

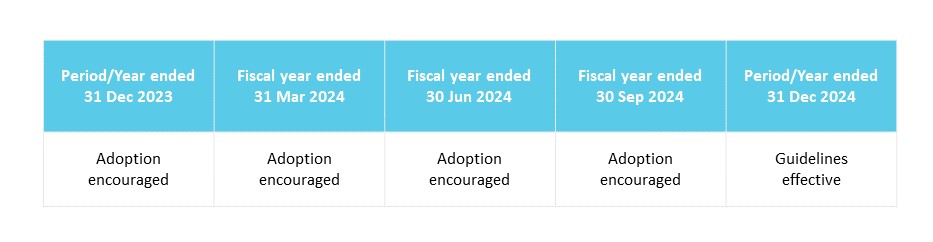

For vehicles to be compliant with this module, a transition period has been established. Investment managers and the governing body of the respective vehicle should assess and implement any organisational or reporting changes triggered by adoption of these guidelines during the period up to 31 December 2023. The guidelines will be applicable for reporting periods beginning on or after 1 January 2024. Earlier adoption is encouraged. Many of the guidelines reflect current industry practice and regulatory reporting which should enable partial or full adoption and compliance with this module as soon as possible.

How do you comply?

The Reporting module is a compliance module:

Read more at INREV Adoption and Compliance Framework.

The purpose of the Reporting module of the INREV Guidelines is to provide investment managers with a generic reporting framework that meets investors’ needs for comparability and transparency of information and facilitates their decision-making processes through relevant disclosures.

This module includes a list of required disclosures. In addition, users are encouraged to adopt a set of recommended guidelines related to asset-level reporting and sustainability metrics. If an investment manager chooses to adopt the recommended disclosures, the related definitions may be followed. The recommended disclosures are voluntary and do not trigger non-compliance with the Reporting module.

In principle, investment managers should annually report basic data including the characteristics of a vehicle, commentary on vehicle performance and an analysis of the relevant KPIs. The annual report also informs investors about the vehicle’s investment strategy, risk policies and exposures and how the investment manager has complied with its business objectives and policies.

The annual report is commonly composed of the annual review of the performance and activities of the vehicle for the year and the financial statements prepared under relevant GAAP. Alongside an annual report, investment managers should also provide interim reports to investors. The frequency and the level of detail of interim reporting should be defined in vehicle documentation.

Interim reports commonly aim to update investors on the activities and performance of the vehicle during the interim period covered, and provide details of any significant changes that have or could have a material impact on the vehicle’s organisation, governance and risk profile. As well as interim reports, there may be other more informal investor updates and ‘flash’ reports which are prepared on a more frequent basis (eg, monthly), which are outside the scope of the guidelines.

Quantitative data and KPIs, as defined in the Standard Data Delivery Sheet (SDDS), are an integral part of investor reporting under these guidelines and such information should be included in the reports to investors. The ESG KPIs will be included in a new standardised reporting template for ESG data and metrics (2023 release). This template will be integrated into the SDDS.

The quantitative data can be presented in a separate attachment to the annual or interim reports (using the SDDS template) or embedded into the relevant section of the report itself depending on the investment manager’s preference.

The framework of the Reporting module comprises the following topics:

The specific considerations incorporated into the Reporting module are as follows:

Annual and interim reporting to investors may include audited annual financial statements or abridged interim financial statements prepared in accordance with the appropriate generally accepted accounting standards.

The investment manager is free to present the INREV report disclosures as a single package together with the audited financial statements or in two separate documents.

Some investment managers may also opt to provide investors full financial statements on an interim basis. Such financial statements may contain some of the information required to be disclosed by these reporting guidelines and can be referred to as appropriate.

Information in the respective financial statements should be consistent with information presented in the annual or interim reports as a whole.

The reporting guidelines focus on the content of investor reports but do not prescribe the organisation and format of such reports.

The INREV SDDS is a standardised data tool that provides investors with the main financial management information they require in a format that allows them to easily upload the data into their own systems. Each reporting requirement has been referenced to relevant SDDS data fields and shows the relationship between the content of annual and interim reports.

The principles and guidelines for reporting are listed below. The frequency column indicates whether the guidelines are an annual reporting requirement or an interim reporting requirement. Where appropriate, further explanation is provided to assist the understanding of the user. In addition, the Tools and Examples section available on the INREV website contains a debt and derivatives disclosures note, a reporting self-assessment tool, the SDDS template, and examples of sustainability reporting and reporting on capital calls and distribution.

The governing body of the vehicle, in collaboration with the investment manager should evaluate the level of compliance with the requirements included in the guidelines – see RG09 for details.

Annual and interim reporting should be consistent, transparent and provide meaningful information to investors.

The investment manager’s report should contain information relevant to gaining an understanding of the overall performance of the vehicle and of its property portfolio, and factors that may affect performance in the future.

If the periodic reports have been externally verified or assured, a link or reference to the external assurance report should be provided; in addition, information on what has been assured and on what basis, including the assurance standards used, the level of assurance obtained, and any limitations of the assurance process should be disclosed.

1.1 Vehicle documentation for reporting framework

|

The basis, frequency and timing of delivery of the audited and non-audited financial statements, and management reporting for investors should be defined in the vehicle documentation. |

Annual |

Interim |

|

For annual reports, define any terms or KPIs not already included in Definitions. |

Annual |

|

1.2 Content and frequency of reporting

|

The quantitative information presented in the SDDS should be provided either using the SDDS template proposed by INREV or otherwise disclosed in annual and interim reporting to investors. |

Annual |

Interim |

|

The financial statements provided in the annual report to investors should be audited. |

Annual |

|

|

Elements of the overall package of annual and interim reporting to investors, however configured, should be internally consistent.

For instance, information presented in the manager, property and other reports should be consistent with information in the SDDS template, if separate, and the financial statements. Also, the basis of preparation of information contained in interim reporting to investors should be consistent with annual reporting to investors. Any differences or exceptions should be explained. |

Annual |

Interim |

|

Full year-end audited financial statements should be provided to investors. These should contain:

SDDS references: 1.13 Accounting standards, 1.15 Vehicle Auditor, 3.3 Cash and cash equivalents, 3.4 Total Number of Outstanding Shares, Section 11. details of fees paid to the manager and affiliates, 13.6 Net Capital Contributed – During the Reporting Period. |

Annual |

|

|

Full year-end audited financial statements should be provided to investors. These should contain:

SDDS references: 1.13 Accounting standards, 1.15 Vehicle Auditor, 3.3 Cash and cash equivalents, 3.4 Total Number of Outstanding Shares, Section 11. details of fees paid to the manager and affiliates, 13.6 Net Capital Contributed – During the Reporting Period. |

Annual |

|

|

Abridged interim financial statements should be provided to investors. Investment managers and investors should agree on the format of the interim financial statements. |

|

Interim |

|

For interim reports, use the same terminology and KPIs as used in the annual report. If new terms or KPIs are used, the investment manager should explicitly define them. Same as RG06 |

|

Interim |

|

For annual reports, describe the overall status of the vehicle’s INREV compliance.

Management (in the event that, for instance, the INREV Governance framework is not being adopted) and/or independent non-executive directors/those in charge of governance should review this statement and the basis for making it. |

Annual |

|

|

For interim reports, disclose the level of compliance with INREV interim reporting guidelines. Reference should be made to the annual report for detailed description of the level of compliance with reporting requirements. |

|

Interim |

|

Disclose that the interim report should be read in conjunction with year-end investor report. |

|

Interim |

1.3 Vehicle characteristics and governance

|

General information on the vehicle characteristics including, among others, name, domicile, legal form, vehicle style (by reference to INREV’s vehicle style definitions), description of vehicle structure, vehicle currency, vehicle year-end. 1.1 Vehicle Name, 1.7 Vehicle Jurisdiction, 1.8 Legal Vehicle Structure, 1.9 Vehicle Structure, 1.12 Vehicle Reporting Currency, 1.6 Vehicle Financial Year-end |

Annual |

Interim

Describe material changes |

|

Contact details of the vehicle. |

Annual |

Interim Describe material changes |

|

Describe the vehicle’s governance framework and the organisation of management and administration. For example, identify the AIFM, administrators, trustees, depositories, general partners, risk managers, investment advisors, portfolio managers, asset and property managers, valuers and other key functions as appropriate. Identify and discuss vehicle governance and oversight frameworks such as the use of independent non-executive directors and investor or other special committees, and how they operate.

SDDS references: |

Annual |

Interim

Describe material changes |

|

Describe the structure and governance principles of the investment manager organisation (rather than the vehicle), for instance on potential areas of conflict between alternative capital sources under management, conflict management processes, investment committee composition and processes, alignment through promote distribution etc. |

Annual |

Interim

Describe material changes |

|

Describe the level of adoption of the INREV governance best practices. |

Annual |

Interim

Describe material changes |

|

Annual and interim reports should describe any material changes to the level of compliance with the (vehicle) governance framework defined in the vehicle documentation. |

Annual |

Interim

Describe material changes |

|

Present a short, high-level summary of the vehicle strategy.

SDDS references: |

Annual |

Interim

Describe material changes |

|

Describe key milestone dates in the life of the vehicle (including vehicle term, investment period, closing dates, etc).

SDDS references: |

Annual |

Interim

Describe material changes |

|

Describe the investment stage of the vehicle in the context of key milestone dates, by sector/geography.

SDDS references: |

Annual |

Interim

Describe material changes |

2.1 Capital structure and vehicle-and asset-level returns

|

Annual and interim reports should disclose any changes to the capital structure of the vehicle. |

Annual |

Interim

Describe material changes |

|

In a tabular format, disclose the status of investor commitments and capital invested in the vehicle, and in particular:

In addition, the investment manager should disclose the expected drawn commitments, returns of capital/redemptions, capital calls and redemption requests for the following period. The investment manager may include assumptions used to determine these projections. |

Annual |

Interim Describe material changes |

|

Summarise and comment on key investor returns and related metrics which are defined in Section 7 of the SDDS (including comparison with targets, points of reference and indices when relevant).

SDDS references: |

Annual |

Interim |

|

|

||

|

In addition, the investment manager may also analyse the performance at an aggregated asset level for a group of assets or for each operating asset during the period by reference to relevant asset-level KPIs defined by INREV as well as the currency used in the performance measurement of each asset.

INREV Performance Measurement module reference: |

Annual |

|

|

Disclose and discuss details of share class NAVs (accounting NAVs, trading NAVs, INREV NAVs as applicable) and variances since prior period-end. |

Annual |

Interim |

|

Disclose and discuss distributions made during the period and subsequent to the period-end (link with underlying transactions such as property disposals where relevant).

SDDS references: |

Annual |

Interim |

|

Summarise how the vehicle’s fee structure impacts the vehicle’s capital structure and vehicle-level returns; for instance, describe any fee capitalisation arrangements.

SDDS references: |

Annual |

Interim

Describe material changes |

|

INREV NAV disclosure requirements Investment managers should make the following disclosures related to the NAV computation:

Explanatory notes to the reconciliation should describe key assumptions, methods used, and in particular:

The investment manager should, however, estimate and disclose the amount of disposal costs likely to be incurred on the sale of properties, taking account of the intended method of exit, assuming an exit without duress and in the current market environment;

|

Annual |

Interim

Describe material changes |

|

The constituent elements of the fee and expense metrics calculation should be disclosed in the annual report. |

Annual |

|

|

The information in the following tables should be disclosed in the annual report. |

Annual |

|

|

A disclosure table should be presented that provides an analysis of all the components of the fees charged by the investment manager, including any element of performance fee or carried interest or any other such arrangement, or by any other affiliate or related party of the investment manager.

See table in Fee and expense metrics module. SDDS references: |

Annual |

|

|

Summarise and discuss macro-economic factors which have, or may have, a material impact on the results of the vehicle.

This should include information such as economic growth factors and their impact on the demand for new rentals, the supply of property or availability of development opportunities. Include also details of material changes in the tax and regulatory environment and debt financing conditions, such as movements in interest rates and financing terms. |

Annual |

|

|

Tabulate for clarity a summary of significant events affecting the vehicle during the period as well as significant events anticipated in the 12 months from the balance sheet date. Provide a brief commentary on significant activities of the vehicle including acquisitions, disposals, distributions to investors, and changes to the overall financing or capital structure during the period. |

Annual |

Interim |

|

Analyse the performance of the vehicle during the period by reference to relevant vehicle-level KPIs defined in sections 3.1, 3.2 and 5 of the SDDS, which include information such as the NAV, key financial ratios, valuation results, realised gains and losses and information related to operating results.

SDDS references: |

Annual |

Interim |

|

Describe and comment on the structure of fee arrangements with investment managers and affiliates (including details of any relevant capitalisation or disbursement programs, year-end balances, amounts earned, accrued, paid or clawed back). Link accrued and un-accrued amounts with the realisation of performance criteria.

When applicable, this description should include details of:

Refer to the relevant sections of the financial statement disclosures for details as appropriate. SDDS references: |

Annual |

Interim

Describe material changes |

|

Disclose the NAV of the vehicle and the basis of calculating it. Disclose to what extent the INREV NAV guidelines have been used to determine such NAV, and include details of adjustments made to reconcile the NAV with the financial statements. Include a description of the judgments and estimates used when determining the INREV or other NAV.

SDDS references: See G09 for Open end fund pricing best practice |

Annual |

Interim

Disclose the NAV and material changes |

|

Discuss the current period performance in the context of the track record of the vehicle (for instance, over the last five years). |

Annual |

|

|

Describe all significant subsequent events affecting the vehicle since the period-end and comment on their impact on vehicle performance. Information at the asset level may be disclosed, if relevant. |

Annual |

Interim |

|

Describe the likely developments in the vehicle’s activities and operations in the foreseeable future and how this is aligned with achieving the overall vehicle objectives. |

Annual |

|

|

Describe the impact of potential or implemented regulatory changes that affect or may affect the vehicle’s and assets’ operations and performance. |

Annual |

|

|

Describe and comment on any significant one-off events having an impact on the results for the period. This disclosure should include, for instance, costs related to litigation, abort deal costs, one-off property related expenses and any other extraordinary or exceptional items. |

Annual |

Interim |

|

Describe and comment on current developments in the vehicle’s investment property portfolio by reference to, for example, occupancy level, tenant profile by area occupied, average rent, the percentage of newly developed property that has been let or sold, etc.

The following information may be disclosed for each asset, including but not limited to:

See RG23 for financial performance returns recommended at asset level. SDDS references: INREV Asset Level Index references/ identifiers: |

Annual |

Interim |

|

Describe the business rationale for any significant acquisitions or disposals during the period, and their impact on the vehicle’s financial position and results.

SDDS references: |

Annual |

Interim |

|

For interim reports, show a summary of the portfolio allocation by sector and geography.

SDDS references: |

|

Interim |

|

For annual reports, show a summary of the portfolio allocation by sector and geography and comment on it in the context of the investment strategy of the vehicle (refer to the detailed portfolio allocation sheet in the SDDS).

SDDS references: |

Annual |

|

|

Disclose the nature and frequency of property valuations, explaining how they reflect the expectations of investors and ongoing business needs of the vehicle (refer to PV15 of the Property Valuation module).

Describe the procedures and internal controls put in place to appoint external valuers and oversee the valuation process to ensure it is objective and free from any bias and not influenced by potential conflicts of interest.

At a minimum, disclose:

Summarise and comment on the current property valuation methods and outcomes.. Include information on the methodologies used and the key market inputs and assumptions such as yields, discount or capitalisation rates. Describe any specific or special assumptions used in the property valuations such as assumed disposal scenarios, assumed capital expenditure and the treatment of transfer taxes.

At a minimum disclose (refer to PV21):

SDDS references: |

Annual |

Interim

Describe material changes |

|

Disclose the proportion of the property portfolio which has been subject to an independent external valuation along with references to the name and qualifications of the valuers, and the date of such valuations. Include details of any modifications or reservations disclosed in the valuers’ reports.

See also RG14. Disclose the qualifications of the members of the governing body of the vehicle, who oversee the valuation process (refer to PV11 of the Property Valuation module). SDDS references: |

Annual |

|

|

Provide an analysis of like-for-like movements in the market value and rental income of properties held in the current and prior periods. |

Annual |

|

|

Comment on the development of rental growth and expected rental values by sector/geography. The market data provided should be relevant to the specific activities of the vehicle. |

Annual |

Interim Describe material changes |

|

Describe recent leasing renewal activity, including incentives given, rent-free periods and tenant improvement programs and expected future changes by reference to market trends in new lease terms. |

Annual |

Interim Describe material changes |

|

Summarise and comment on the development of vacancy rates and its impact on vehicle performance and future prospects.

SDDS references: |

Annual |

Interim Describe material changes |

|

Discuss the development of property yields, including yields by sector and geography.

SDDS references: |

Annual |

Interim Describe material changes |

|

Discuss the development of other key property information by sector and geography, when relevant. |

Annual |

Interim Describe material changes |

|

Identify and comment on rental concentration risk (either by expected rental value or actual rental value). |

Annual |

Interim Describe material changes |

|

Describe and comment on the level of property operating costs and, if significant, discuss the impact of specific factors such as service charge recoveries, bad debt write-offs and other property operating costs related to the vehicle’s performance. |

Annual |

Interim

|

|

If material, describe the impact of development activities on the vehicle by reference to, among other things, its investment strategy, development pipeline, stage of completion of developments, status of the sale of units or rental strategies. |

Annual |

Interim

|

|

Discuss and quantify significant capital expenditure programs either planned or being undertaken during the period for existing properties, such as renovations, extensions and improvements.

SDDS references: |

Annual |

Interim |

|

Quantify the amount of property development being undertaken during the period. Include details of the number of properties completed and either transferred to investment properties or sold during the period. Include details of development costs, related commitments, and the method of accounting for properties under development.

SDDS references: |

Annual |

Interim |

|

Describe and quantify the vehicle’s position in joint ventures and associate investments. Include details of, among other things, the methods of accounting for such positions, how they impact the overall financial and risk profile of the vehicle, and their business prospects. |

Annual |

Interim |

|

Summarise and comment on returns from non-property investments such as positions in other vehicles, listed securities and other assets. |

Annual |

Interim |

|

In exceptional circumstances, deviations by investment managers from property valuations as determined by external property valuers should be clearly explained and disclosed.

If there is a disagreement between the investment manager and the property valuer on the market value parameters, these parameters must be clearly explained and disclosed. See more details at PV23 of the Property Valuation module. Whatever the circumstances, appropriate internal procedures (including escalation measures) should be followed by the management in the event of valuation adjustments. |

Annual |

Interim |

|

Describe the principal risks faced by the vehicle. Describe and analyse the vehicle’s current exposure to such risks. Principal risks will cover, among others, areas such as:

As an integral part of the disclosure of the description and analysis of principal risks and their current status, the specific ESG considerations and risks should be included – see ESG15 of the Sustainability module. Exposure to shareholder loans should be analysed separately from external loans. |

Annual |

Interim Describe material changes |

|

Describe the overall organisation of the risk management function and refer to key policies and procedures to monitor and mitigate exposures to key risks and uncertainties.

|

Annual |

Interim Describe material changes |

|

Summarise the vehicle’s current risk appetite and tolerance levels. Describe the level of compliance with this framework and comment on any specific breaches and remedial plans. |

Annual |

Interim Describe material changes |

|

In a tabular form, give details of the overall financing structure of the vehicle. Include information such as financing costs, lender, security arrangements, recourse arrangements, maturity, and interest and loan amortisation terms. Refer to the financial statement disclosures as appropriate.

SDDS references: |

Annual |

Interim Describe material changes |

|

Comment on the overall financing structure of the vehicle by reference to its overall strategy and future prospects. Such commentary should provide information on the status of material new debt arrangements, early debt reimbursements, and debt restructuring programs relevant to the period or anticipated in the foreseeable future.

SDDS references: |

Annual |

Interim Describe material changes |

|

Describe and comment on the vehicle and SPV’s current key financing ratios, for example, interest service coverage ratio, property level loan to value gearing ratio and the vehicle’s general level compliance with such ratios. SDDS references: |

Annual |

Interim Describe material changes |

|

Describe and comment on the use of derivative financial instruments and their impact on the vehicle’s performance. Disclose their key terms and fair values and their treatment in the financial statements and NAV.

SDDS references: |

Annual |

Interim Describe material changes |

|

Describe and comment on the vehicle’s overall financing income and charges by reference to the vehicle’s financing structure, cash balances, changes in market conditions etc.

SDDS references: |

Annual |

Interim Describe material changes |

The sustainability reporting requirements and recommendations for ESG-related aspects are presented below.

The investment manager should disclose this information to investors in a clear and concise manner. INREV does not prescribe the structure and format of ESG reporting. This can either be disclosed in an ESG-dedicated section, embedded in other sections of annual/ interim reports, or presented as a standalone sustainability report / integrated report.

|

The investment manager, in collaboration with the governing body of the vehicle, should clearly state in the constitutional documents the vehicle’s intended level of adoption of the Sustainability guidelines and perform an annual self-assessment of the effectiveness of its intended implementation.

To enable investors to fully understand the nature and extent of compliance of the vehicle’s intended governance framework with the INREV Guidelines, an initial as well as an ongoing annual self-assessment should be performed by the investment manager and the governing body of the vehicle, and the results disclosed appropriately in their reporting to investors. See also RG16 and RG17. |

Annual |

|

|

The investment manager should describe in their reporting to investors the overall ESG strategy and objectives of the vehicle together with the associated targets and how these goals will be facilitated by the organisation and governance framework of the vehicle.

The investment manager should include in its ESG reporting a description of the vehicle’s ESG strategy and the process through which it was derived. This description should include but is not limited to the following information:

Certain legacy vehicles or funds which opt not to have a coherent ESG strategy and objectives should nonetheless disclose this status and provide any relevant explanations. |

Annual |

|

|

The investment manager should specifically disclose in their reporting to investors the climate change strategy and objectives of the vehicle.

As part of ESG reporting, the investment manager should consider the following aspects related to climate change:

Certain legacy vehicles or funds which opt not to have a coherent climate change strategy should nonetheless disclose this status and any relevant explanations. |

Annual |

|

|

The investment manager should disclose, as part of their reporting to investors, ESG initiatives at the property portfolio level and comment on the progress made against any specific targets as defined in the vehicle’s ESG strategy.

When reporting to investors on ESG initiatives related to asset strategies and business plans, the investment manager should consider the aspects set out under ESG08, ESG12, ESG13 and ESG14. These aspects include but are not limited to the following information:

Certain legacy vehicles or funds which opt not to have a coherent ESG asset management strategy should nonetheless disclose this status and any relevant explanations. |

Annual |

|

|

The investment manager should disclose and explain a set of essential key performance indicators which are aligned with the overall strategy of the vehicle.

The investment manager should define a set of key performance indicators, which cover the entire portfolio, both under the manager’s and the occupiers’ operational control, in accordance with ESG objectives of the vehicles, and include the required INREV ESG vehicle-level KPIs.

Reference should be made to ESG factors covered in Table 1 of ESG02 of the Sustainability module.

For the purposes of reporting on governance matters, the results of self-assessment against INREV’s governance best practices should be included (see reporting guidelines of the Governance module).

Data disclosure may be presented in line with widely recognised methodologies (eg GRESB, CRREM, GRI, TCFD, SBTi) (see list of abbreviations in Appendix 4 under Tools and Examples). If such a methodology is adopted, the investment manager should disclose the specifics of the calculation methodology applied, explaining for example, how normalisation factors and what types of energy or emissions were included in the ratio.

Disclosures and explanations should consider both absolute and like-for-like data.

Management’s analysis and discussion of data presented, eg intensity ratios and emission data by property type, should be included.

Disclosures should clarify the degree to which estimated data was used in determining overall values for elements that are outside of the manager’s operational control, or for which data could not be reliably collected.

The INREV ESG vehicle-level KPIs include “data coverage” indicators to promote data transparency. If the data related to any of the indicators is not available or not applicable, the investment manager should explain this. For instance, whereas the data for energy consumption and renewable energy under the manager’s control should be available, the data under the occupiers’ control or allocation by floor area may not be available or may need to be estimated.

The investment manager may also consider reporting the essential KPIs on an asset-level basis. If the investment manager chooses to adopt this recommendation, the related data definitions set above for vehicle-level reporting should be followed. |

Annual |

|

|

Key Factors |

Indicator ID |

Indicator |

Units of Measure |

|---|---|---|---|

|

Environmental KPIs (annual disclosure) |

|||

|

Energy consumption1 |

ENV1 |

Energy consumption, for the proportion of portfolio that is in landlord’s control |

kWh |

|

ENV2 |

Energy consumption, for the proportion of portfolio that is in tenant’s control |

kWh |

|

|

ENV32 |

Estimated energy consumption (separate disclosure for the proportion of portfolio that is in landlord’s and tenant’s control) |

kWh |

|

|

ENV4 |

Total energy consumption (ENV1 + ENV2 + ENV3) |

kWh |

|

|

ENV53 |

Total energy consumption data coverage, by area4 |

% of m2 |

|

|

ENV63 |

Energy intensity (based on ENV4) (SFDR Annex 1 Table 2 Additional Real Estate PAI – 19) 4 |

kWh / m2 |

|

|

ENV73 |

Energy intensity (based on ENV4), by property type4 |

kWh / m2 |

|

|

Renewable Energy |

ENV83 |

Generated and consumed on-site by landlord (SFDR Annex 1 Table 1 Universal PAI - 5) |

kWh |

|

ENV93 |

Generated on-site and exported by landlord (SFDR Annex 1 Table 1 Universal PAI - 5) |

kWh |

|

|

ENV103 |

Generated and consumed on-site by third party or tenant (SFDR Annex 1 Table 1 Universal PAI - 5) |

kWh |

|

|

ENV113 |

Generated off-site and purchased by landlord (SFDR Annex 1 Table 1 Universal PAI - 5) |

kWh |

|

|

ENV123 |

Generated off-site and purchased by tenant (SFDR Annex 1 Table 1 Universal PAI - 5) |

kWh |

|

|

ENV13 |

Renewable energy data coverage, by area4 |

% of m2 |

|

|

Greenhouse Gas Emissions (GHG) |

ENV142 |

Direct emissions – Scope 1 (SFDR Annex 1 Table 2 Additional Real Estate PAI – 18) |

tonne CO2e |

|

ENV152 |

Indirect emissions – Scope 2 (SFDR Annex 1 Table 2 Additional Real Estate PAI – 18) |

tonne CO2e |

|

|

ENV162 |

Indirect emissions – Scope 35 (SFDR Annex 1 Table 2 Additional Real Estate PAI - 18) |

tonne CO2e |

|

|

ENV172 |

Estimated emissions, by scope 1, 2, 3 |

tonne CO2e |

|

|

ENV18 |

Total operational carbon (ENV14 + ENV15 + ENV16 + ENV17) (SFDR Annex 1 Table 2 Additional Real Estate PAI - 18) |

tonne CO2e |

|

|

ENV193 |

Total operational carbon data coverage, by area4 |

% of m2 |

|

|

ENV203 |

Operational carbon intensity (based on ENV18) (SFDR Annex 1 Table 1 Universal PAI - 3) 4 |

tonne CO2e / m2 |

|

|

ENV213 |

Operational carbon intensity (based on ENV18), by property type4 |

tonne CO2e / m2 |

|

|

Climate Change – Transition Risks and Opportunities |

ENV22 |

Exposure to fossil fuels through real estate assets (SFDR Annex 1 Table 1 Real Estate PAI – 17) |

% of AUM |

|

Climate Change – Physical Risks and Opportunities |

ENV232 |

Proportion of assets that fall into low / medium / high physical risk categories |

% of AUM |

|

Water Consumption |

ENV24 |

Water consumption, for the proportion of portfolio that is in landlord’s control |

m3 |

|

Waste Management |

ENV25 |

Waste generated, for the proportion of portfolio that is in landlord’s control |

tonne |

|

Building Certificates |

ENV263 |

Percentage of assets with a certificate6, by area4 |

% of m2 |

|

Energy Ratings |

ENV273 |

Percentage of assets with an energy rating6, by area4 |

% of m2 |

|

ENV28 |

Exposure to energy-inefficient real estate assets (SFDR Annex 1 Table 1 Real Estate PAI 18) |

% of AUM |

|

Notes:

1. Energy consumption figures include total of different energy types used, including the renewable energy sources (see the details in Appendix 1).

2. Explain the methodology used to calculate this indicator and/or to determine the components used.

3. KPIs aligned with INREV ALI ESG data fields.

4. Recommended unit of measure for data coverage is by area, investment managers may identify and report KPIs on value (AUM basis).

5. Scope 3 emissions in the INREV sustainability reporting guidelines are calculated as the emissions associated with tenant areas, unless they are already reported as Scope 1 or Scope 2 emissions. Scope 3 emissions do not include embodied carbon as it is listed separately as a recommended KPI under Appendix 1. Scope 3 emissions cover only operational activities of the portfolio of the vehicle and do not include emissions generated through the organisation’s operations or by its employees, or upstream supply chain emissions.

6. For the full list of certificates/energy rating schemes, please see INREV ALI sustainability data fields which is referenced to GRESB Asset Spreadsheet

|

The investment manager should report to investors any material information related to specific events or initiatives linked to the vehicle’s ESG strategy or status.

During the lifecycle of a vehicle, there may be situations or unforeseen events, including ESG-related issues, that the investment manager understands to be material to the outcomes of investors, which warrant timely and clear communication to investors outside regular reporting obligations. The investment manager, together with the governing body of the vehicle, should enable such communications to take place through appropriate channels such as written reports and/or convening meetings. The information communicated should be relevant and reliable – see ESG11 and ESG16 of the Sustainability module for details on reporting framework. |

Annual |

|

|

The investment manager should provide a statement of the current level of compliance with applicable ESG legislation and its exposure to possible future regulatory developments.

ESG reporting should detail the vehicle’s approach for ensuring compliance with current legislation relating to ESG issues and preparations for any future legislation that may be undertaken over its life cycle (see ESG01 of the Sustainability module). It should detail objectives and specific actions for ensuring compliance with current ESG regulations and describe the steps to prepare for any upcoming legislation.

The investment manager should report against compliance with current legislation requirements and objectives and associated targets for preparations for upcoming legislation.

The investment manager should determine and disclose the level of disclosure for the vehicle with respect to the regulatory requirements that it is subject to (considering the regulatory requirements, such as, SFDR Article 6, 7, 8, 9, 11 and EU Taxonomy regulation).

The investment manager should describe and explain whether the vehicle is obligated to report under SFDR and if so whether its investment strategy meets the requirements. |

Annual |

|

|

The investment manager should provide an adequate summary and current status of the principal ESG risks faced by the vehicle as part of their overall risk- related disclosures.

Principal risks may cover, among others, areas specified in ESG15 of the Sustainability module. |

Annual |

|

|

The investment manager should disclose whether any ESG information reported has been verified or assured by a third-party.

If certain ESG data included in periodic reports have been externally verified or assured this should be disclosed and a link or reference to the external assurance report(s) or assurance statement(s) should be provided. |

Annual |

|

|

In addition to its overall obligations to report to investors a set of essential key performance indicators (RG73), the investment manager may consider and report a recommended set of performance measures relevant to the ESG objectives and associated targets set for the vehicle.

As well as complying with RG73, the investment manager may consider and report additional key performance indicators in accordance with the ESG objectives of the vehicle – see list of recommended KPIs for real estate investments in Appendix 1. Reference may be made to ESG factors covered in Table 1 of ESG02.

If the investment manager chooses to adopt the recommended disclosures, either at vehicle or asset level, data coverage, disclosures and explanations should follow the general and specific calculation requirements described under RG73. |

Annual |

|

Appendices

The Reporting module assessment relates to the 2014 version. The assessment for the 2023 version is now available.

How should a manager apply the interim and annual reporting requirements when four detailed quarterly or two semi-annual reports are provided to investors?

The INREV reporting guidelines focus on the content rather than the format of the reports to investors.

Many managers prepare three or four quarterly interim reports or one semi-annual report along with a more complete annual report, including commentary on the last quarter/half year. Although these interim reports are expected to be in an abridged form, they can also contain all the disclosures set out in the annual reporting requirements at the manager’s discretion. The reporting guidelines reflect the minimum requirements with respect to the content of the report to investors.

In some circumstances, managers provide to investors four quarterly reports or two semi-annual reports with annual financial statements provided separately. These reports contain all the disclosures set out in both the interim and annual reporting requirements and, therefore, comply with such requirements. In such case, the annual report accompanying the financial statements may only include a summary of the information provided in the detailed interim reports.

IFRS 16 requires reclassifying liabilities resulting from future lease payments of land use rights from the property value to financial liabilities. Does this change trigger a change in the computation of the INREV GAV as determined for the INREV expense ratio purposes?

The INREV GAV calculated for the INREV expense ratio purposes should be presented net of future lease payments of land use rights, similarly to what has been done prior to IFRS 16 endorsement. This will align treatment and presentation of these lease payment under INREV with current treatment and presentation by external valuers in the valuation reports.

IFRS 16 requires accounting for lease payments as interest expenses and repayment of lease obligation. Shall we include these lease payments as part of the numerator of the INREV REER?

The INREV REER should include the lease payments incurred during the reported period. The lease payments aim to indemnify the landlord for the maintenance of the building. In case the vehicle would own the building, such costs would be typically included in the REER. Nevertheless, such payments would typically have an immaterial effect on the INREV REER and on any key investment decisions.

How should acquisition costs be treated under INREV in case of merger of funds?

In case of merger of funds with substantial impact on vehicle documentation, strategy and investor base, the unamortised portion of historical acquisition costs from historical structures should be taken over and capitalised and amortised over five years along with the new setup costs arising from the merger.

How should performance fee be recognised for INREV NAV calculation purposes?

For the purposes of calculating INREV NAV, in case the performance hurdle is exceeded, at reporting date, based on the calculation methodology stated in the vehicle documentation, the performance fee should be recognised in full. Care should be taken to assess uncertainty surrounding estimates of income.

November 2023: The disclosure requirements under RG45 have been updated.

This checklist allows to assess the level of compliance with the INREV Reporting Guidelines. It summarises the disclosure requirements for annual and interim reporting that need to be fulfilled to state compliance with the module.

The annual report is commonly composed of the annual review of the performance and activities of the vehicle for the year and the financial statements. As well as an annual report, managers should provide interim reports to investors, whose frequency and level of detail should be defined in the fund documentation. Interim reports commonly aim to update investors on the activities and performances of the vehicle during the period covered, and provide details of any significant changes that have or could have a material impact on the vehicle’s organisation, governance and risk profile.

If you have any questions please contact the Professional Standards Team under professional.standards@inrev.org or phone +31 (0)20 235 8600.

Please select the module(s) you would like to download