Source: -

Source: -

Source: -

Source: -

No about page exists.

What has changed?

The updated module includes new best practices related to the governance and oversight of the valuation process. The guidelines are now assembled under the principles of the Governance module. The language reflects the roles and responsibilities of the valuation function, in line with the latest regulations such as AIFMD. In addition, the module introduces guidelines related to the disclosure of sustainability inputs when determining market values to increase transparency over the potential impact of sustainability factors.

When it becomes effective?

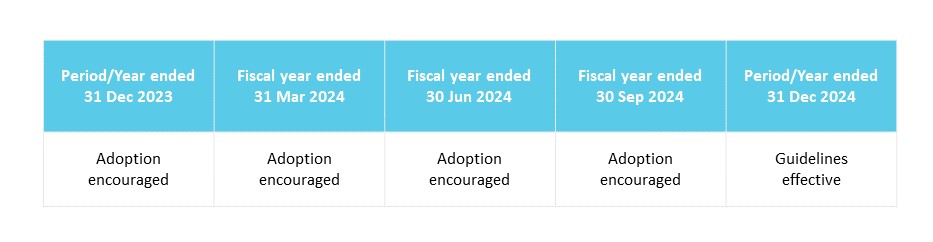

For vehicles to be compliant with this module, a transition period has been established. Investment managers and the governing body of the respective vehicle should assess and implement any organisational or reporting changes triggered by adoption of these guidelines during the period up to 31 December 2023. The guidelines will be applicable for reporting periods beginning on or after 1 January 2024. Earlier adoption is encouraged. Many of the guidelines reflect current industry practice and regulatory reporting which should enable partial or full adoption and compliance with this module as soon as possible.

How do you comply?

The Property Valuation module is a best practice module:

Read more at INREV Adoption and Compliance Framework.

The INREV Property Valuation module provides a generic framework for the conduct of the property valuation process, its oversight and governance. Although the module specifically focuses on the valuation of property, the general principles of governance and oversight applied in this process are equally relevant to estimating the fair value of other assets and liabilities making up the Net Asset Value (NAV) of the vehicle.

There are also relevant governance guidelines applicable to the oversight of judgements and estimates in general made by management in establishing the NAV of the vehicle as well as specific transparency requirements.

For more information see INREV Governance, INREV NAV and INREV Reporting modules.

The market value of property is a fundamental concept that supports various aspects of the real estate market. As well as being a key performance attribute at an asset level, it is also used in development appraisals and facilitating financing arrangements.

Property values are a key component in the assessment of the NAV which drives a number of performance measures and underlies the determination of pricing of units, management and performance fee arrangements as well as compliance with loan covenants. It is therefore important that investors have confidence in the valuation process for the vehicles in which they invest and have access to objective, consistent and transparent information regarding valuation outcomes. Information about property valuations is also utilised by other stakeholders in the non-listed real estate market such as lending banks and regulators.

Market value, as defined by the International Valuation Standards (IVS), is the estimated amount for which an asset or liability should exchange on the valuation date between a willing buyer and a willing seller in an arm’s length transaction, after proper marketing and where the parties had each acted knowledgeably, prudently and without compulsion.

In this context, the fair value of a property is its market value. For the purposes of this module, property comprises all real estate assets related to the rights of ownership and development of land and physical construction thereon. Underlying market values are determined by independent and qualified external valuers engaged by the investment manager.

The external valuer, as defined by the Royal Institution of Chartered Surveyors (RICS), is a professional valuer who, together with any associates, has no material links with the client, an agent acting on behalf of the client or the subject of the assignment. The valuation function, along with its related roles and responsibilities, is also defined by applicable regulations (for example Alternative Investment Fund Managers Directive in Europe). For more information on the roles of parties involved in vehicle governance see Governance module.

Although the purpose and use of property valuation outcomes may vary across a wide range of vehicle types (eg open end, closed end), the fundamental concepts that drive the integrity of the valuation process remain the same. Property valuations should be determined at least once a year but may be more frequent depending on the vehicle type or economic circumstances.

The module consists of general best practices which are not intended to prescribe technical valuation methodologies or to provide specific instructions on how to assess the market value of a property. These methodologies should be based on applicable regulatory frameworks and valuation standards such as IVS, RICS and European Valuation Standards (EVS).

The Property Valuation guidelines are focused on the determination of market value as described above. Alongside the concept of market value, INREV is currently working on a project to assess the potential for developing best practices on how to model and evaluate future outcomes based on projected cash flows and business scenarios that will meet specified sustainability targets such as net zero or other sustainability criteria. Referring to text and guidelines produced by other industry bodies and regulators on this subject may be relevant.

This module, however, is limited in scope to the disclosure of sustainability inputs into the determination of market value at a valuation date. It does not include the determination of investment value/ worth which takes account of the successful implementation of specific future strategies.

At vehicle launch, the governing body of the vehicle, in collaboration with the investment manager and investors, should design an intended valuation framework that is adapted to the respective vehicle structure and style. As part of this process, the principles and best practice guidelines included in this module should be evaluated and adopted to the extent relevant to the vehicle and referred to in the constitutional documents of the vehicle as appropriate.

The governing body of the vehicle, in collaboration with the investment manager, should thereafter, periodically, perform a self-assessment against the intended property valuation process and framework and take actions as appropriate. The investment manager should describe their property valuation policies and the degree to which they have adopted the INREV Property Valuation best practices in their annual report and vehicle documentation.

Act lawfully and ethically

All parties involved in the valuation process should strive to meet the highest professional standards of ethics and integrity while complying with applicable laws and accounting and valuation standards. Acting ethically goes well beyond mere compliance with the law and written contracts. While estimating property market values, external valuers, investment managers and the governing body of the vehicle should operate under a duty of care and should act ethically and with integrity towards investors and other stakeholders.

Respect for the law and compliance with the constitutional terms of the vehicle, which should contain details of how such market values should be established, provides a basic framework for property valuation. Acting ethically entails the external valuer, the investment manager, the governing body of the vehicle and other relevant actors understanding and adapting how they conduct themselves to ensure the achievement of appropriate and unbiased market values.

Act in the best interest of investors and consider other stakeholders

Identifying and understanding the interests of stakeholders so far as they relate to the valuation process and outcomes may vary from vehicle to vehicle. For instance, in an open end fund, estimates of value are generally used to establish pricing and the remuneration of the investment manager.

In a closed end fund, estimates of value are more orientated towards performance reporting during its lifetime. When establishing an investment vehicle, the design of the property valuation process and the parties involved including the frequency, responsibilities and oversight of the process should be carefully considered.

These elements should be aligned with the interests of investors and other stakeholders, as well as the nature and style of the vehicle concerned. In its actions and conduct in operating and overseeing the valuation process, the investment manager together with the governing body of the vehicle should constantly strive to achieve alignment of interests with investors and other stakeholders, while avoiding conflicts of interest that cannot be effectively managed. Given the fact that the investment manager appoints and oversees the work of independent external valuers and provides them with much of the information used to form an opinion of value, it is particularly important from a governance perspective that the integrity of the valuation process is carefully examined on a regular basis by both the investment manager and the governing body of the vehicle.

In addition, it is important to consider the role of the external auditor and the outcome of their work that provides a rigorous level of assurance about the quality of the valuation process. At the same time, the integrity of the external valuer’s work in providing an independent, objective and unbiased opinion of value is key to the overall process and ultimately to its alignment with the best interests of investors and other stakeholders. It is important that the external valuer has a clear understanding of the scope of work and receives from the instructing party (either the investment manager or the investor) confirmation of the purpose of the valuation when agreeing on the appropriate terms of engagement.

The external valuer should identify and avoid any potential conflicts of interest that cannot be effectively managed. Conflicts of interest can arise from the valuer’s contractual fee and other arrangements with the investment manager as well as potential conflicts resulting from other services provided by related parties and associates of the external valuer and its organisation, such as brokerage.

Act with skill, care and diligence

The investment manager should ensure that its valuation function related to the investment vehicle is conducted prudently with diligence and care. It should also ensure that all parties involved, including its own personnel, the members of the governing body and related service providers behave with the highest standards of conduct and professionalism.

The investment manager should engage personnel who possess specific knowledge, skills and experience related to property valuation. It should constantly strive to apply best practices in arranging and supervising the valuation of property related to the vehicles it manages. The investment manager should effectively engage with the governing body of the vehicle to enable it to effectively monitor its activities related to the valuation function.

Design and operate an adequate oversight and control framework

The investment manager, in collaboration with the governing body of the vehicle, should design and operate an effective supervisory, decision-making and control framework that adequately addresses the specific risks related to an investment vehicle. Such a framework, which extends to key service providers such as external valuers, needs the involvement of sufficiently qualified persons, who should possess the necessary skills and knowledge. The qualification, appointment and supervision of the external valuer should be one of the main focus points of the oversight and control framework.

The oversight and control framework, as well as meeting the legal and regulatory requirements of the vehicle, should ensure that the scope and frequency of the property valuation process fairly reflect the reasonable expectations of investors and the context of market circumstances.

Be transparent while respecting confidentiality considerations

The investment manager should be transparent and disclose accurate, balanced and clear information related to the valuation process and its outcomes, on a timely basis. The investment manager should not only disclose information when there is a legal obligation to do so, such as when it is defined in the constitutional documents of the vehicle but should also proactively communicate and engage with investors and certain key stakeholders where the matter or information is considered relevant.

Be accountable

The investment manager, together with the governing body of the vehicle and other related service providers, should be accountable to investors for the execution of their responsibilities in relation to the valuation process given their roles and functions. This implies a duty of care, acceptance of scrutiny, and a reasonable level of liability.

Be sustainable: Evaluate and manage sustainability impacts

The investment manager should consider sustainability factors that potentially impact the value of a property as part of the overall valuation process. The investment manager should provide or facilitate the provision of a reliable set of information and data relating to the current and future sustainability status of the property on which the external valuer can base their work. Appropriate terms of engagement should be agreed upon with the external valuer to determine their role and the scope of the instruction in terms of sustainability reporting. Investment managers should summarise and disclose to investors the results of this process in a clear and transparent way. This will help investors better understand the economic impact of environmental and social considerations on the value of their portfolio.

The value of the property should be its unbiased market value or fair value.

The valuation methods include, individually or a combination of, among others:

Valuations of property under construction should be stated at market value. Refer to INREV NAV adjustments in the INREV NAV module . The valuation of property under construction should generally be based on the fair value at completion less costs to complete (residual approach). Appropriate focus should be made on the sensitivity associated with input assumptions given the development status of the property.

However, in certain circumstances, the fair value may be determined by using the initial cost of acquisition plus subsequent construction costs. An example is during the initial phases of construction when the level of uncertainty is high. Particular care should be taken to ensure that construction and materials costs are up to date. Irrespective of local legal requirements or contractual obligations, such as vehicle regulations, the valuation methodology applied should lead to market value as defined by these guidelines.

The investment manager should ensure that external valuers comply with applicable laws and a recognised international professional valuation standards such as IVS, RICS and EVS.

All parties involved in the valuation process should strive to meet the highest professional standards of ethics and integrity.

See for more detail the Governance module (G03) and other relevant valuation standards for ethical requirements related to the conduct of the valuer.

The vehicle documentation should include details of the valuation procedure along with the frequency and methodologies used to value all material assets and liabilities of the vehicle, including property.

As a key component of the vehicle’s legal framework, the investment manager should describe the underlying valuation methodologies, procedures performed, specific pricing methodologies (see INREV Governance module for more information) and special assumptions applied for the valuation of hard-to-value assets and liabilities, as appropriate.

The investment manager should design a valuation process that is aligned with the interests of investors and other stakeholders and takes account of the nature and style of the vehicle concerned.

The investment manager together with the governing body of the vehicle should ensure that the valuation process oversight performed by the investment manager is unbiased.

This oversight process should be independent of any potential conflicts of interest such as those arising from management or performance fee arrangements and from other services provided by related parties and associates of the external valuer and its organisation, such as brokerage.

The investment manager should ensure that the external valuer has a clear understanding of the context of their work and the purpose of the valuation.

The investment manager should ensure that the compensation of the external valuer fairly reflects the services provided and should not be directly linked to the outcome of the valuation.

The investment manager should ensure that the appointed external valuer is independent.

The external valuers involved in the valuation process should identify and disclose any threats to their independence or potential conflicts of interest and either manage or avoid them. See also PV11 for appropriate professional qualification requirements that set relevant rules of conduct and ethical standards.

In certain exceptional circumstances, the investment manager, after careful consideration by their valuation oversight function, may decide to adjust the values as determined by the external valuer to reflect their best estimates of market value in specific circumstances such as distressed situations, liquidations and wind-ups reflecting a non-going concern basis.

Such decisions should always be taken in the best interests of investors and other stakeholders and be subject to full scrutiny by the governing body of the vehicle.

The governing body of the vehicle, together with the investment manager and any relevant external parties, should ensure that they have the appropriate skills, market expertise, capacity and competence to estimate the market value of property in the best interests of investors.

This includes the requirement of any external valuer engaged to have the appropriate professional qualifications to perform their work, such as RICS Registered Valuer status, as well as sufficient market understanding to perform a robust valuation.

Given the subjective nature of property valuations and their importance to the financial framework, the governing body of the vehicle should perform effective scrutiny and actively engage with appropriate parties and make their own sound, objective and appropriate decisions when considering the determination of market value in the best interests of investors.

The investment manager should ensure that all parties involved in the property valuation process of the vehicle are adequately trained, familiar with the markets in scope, capable of challenging the work of the external valuer, and have access to appropriate educational programmes.

The investment manager, through its key members of the valuation function, and together with the governing body of the vehicle, should have the capacity and devote adequate time and resources to effectively oversee the valuation process.

The investment manager, together with the governing body of the vehicle, should design and operate an effective system of internal controls over a vehicle’s property valuation process.

Control objectives should include, but are not limited to:

The governing body of the vehicle should undertake a review of the continuing appointment or re-appointment of the external valuer on a regular basis and at least once every three years.

The assessment of the external valuer firm is an ongoing process. A formal assessment should take place at least once every three years, with the objective that the external valuer firm is the best-suited valuer to perform the valuation. The results of the assessment should be reported to investors.

The assessment may result in a rotation of the external valuer firm. The assessment should also include an evaluation of whether the external valuer firm is properly insured against claims and its compliance with regulations, for example, the Alternative Investment Fund Managers Directive (AIFMD) in Europe. In the event of rotation, there should not be any affiliation between the external valuer firms.

See also G25 of the INREV Governance module for guidelines on reviewing the performance of other service providers.

The investment manager should ensure that property valuations are performed at least once a year. The frequency of valuations should be described in the vehicle documentation and should reflect the expectations of investors and the ongoing business needs of the vehicle concerned, such as vehicle pricing considerations.

At a minimum, the scope of external property valuations should include consideration of all properties once a year. More frequent valuations may be required depending on economic circumstances or investor needs. Certain market conditions may present significant uncertainty and volatility requiring more frequent valuation updates. In addition, transactions such as the issuance or redemption of units/shares in certain vehicle types may require specific valuations.

The investment manager should ensure that the external valuer provides a comprehensive valuation report, in line with professional valuation standards, to enable them to adequately review and assess their work.

The external valuer should include in the valuation report key information regarding the valuation method used for each individual property type, such as investment property, property held for sale, property under construction, and ground leases. The scope of work and disclosures should be in line with the relevant valuation standards and their minimum requirements. In addition, all applicable material valuation inputs and market assumptions should be clearly communicated and explained.

Although external valuers may consider different valuation methodologies, the valuation should result in a single number.

There may be situations where different valuation outcomes need to be considered and resolved when determining a fair value. For instance:

In these situations, the investment manager should determine an appropriate valuation methodology that results in a single number.

The fair value of properties used by the investment manager to determine the NAV of the vehicle should be aligned with the requirements of the INREV NAV module.

For instance, the allocation of transfer taxes and purchasers’ costs between a buyer and seller in different structures and market situations should be considered and appropriately reflected (see INREV NAV module).

The governing body of the vehicle should ensure that communication with investors is balanced and fairly represents the activities of the vehicle.

In addition to respecting contractual and reporting obligations, the investment manager should provide further clarity, and timely and accurate information to investors and/ or key stakeholders, as relevant. In pursuing this responsibility, the governing body of the vehicle should always consider the best interests of investors and confidentiality considerations. Information provided to investors should include but is not limited to:

During the lifecycle of a vehicle, the investment manager may decide to adjust the agreed-upon values as determined by the external valuer to reflect their best estimates of market value in certain exceptional circumstances related to the vehicle.

Examples of such exceptional circumstances where factual and objective information support a necessary adjustment include, among others, distressed situations, portfolio sales, liquidations, and vehicle wind-ups reflecting a non-going concern basis of accounting. These adjustments should always be made in the best interests of investors and other stakeholders, and be subject to full scrutiny by the governing body of the vehicle. In such circumstances, timely and clear communication to investors outside of the regular reporting obligations of valuation outcomes may be required. The investment manager, together with the governing body of the vehicle, should enable such communications to take place through appropriate channels such as written reports and/or convening meetings.

The investment manager should ensure that appropriate internal procedures are clearly documented and can be applied in exceptional circumstances, where there may be disagreements between the investment manager and the external valuer on the underlying market value of certain individual assets. Such deviations should be fully communicated and disclosed to investors.

In such exceptional circumstances where the investment manager and the external valuer cannot reconcile their views the market value, as determined by the investment manager, should be reported to investors including full disclosure to justify the deviation from the market value arrived at by the external valuer.

Whatever the circumstances, appropriate internal procedures (including escalation and oversight measures) should be followed by the investment manager and the governing body of the vehicle in the event of valuation adjustments. These deviations and disagreements should occur very rarely and if so, more often in relation to more opportunistic investments, where, for example, the investment manager and the external valuer have different views as to the likelihood of a particular event occurring (because, for example, the investment manager is in discussion with governmental bodies, potential buyers or tenants).

Another example of deviation could relate to disagreements about value changes if there is a considerable time period between the actual date of external valuation and a later reporting date. An additional option in such circumstances is to instruct a further valuation.

The investment manager, together with the governing body of the vehicle, should regularly assess its level of performance in relation to its obligations towards investors and third parties, such as regulators, so far as it relates to the property valuation process, and make improvements as appropriate.

The investment manager and the governing body of the vehicle should be willing to accept a certain level of liability related to property valuations subject to reasonable indemnifications.

There should be a fair allocation of risk to the investment manager and the governing body of the vehicle. The extent of the liability should be in accordance with relevant laws and regulations and be described in the constitutional documents of the vehicle.

At the same time, the investment manager and the governing body of the vehicle should expect to be indemnified by the vehicle for losses, except in cases of fraud and culpable behaviours such as wilful misconduct or gross negligence.

The investment manager should ensure that the external valuer is willing to accept a certain level of liability related to property valuations subject to reasonable indemnifications.

The external valuer should be professionally liable and accountable for their work, in accordance with applicable regulations and the terms of their engagement.

The investment manager should provide or facilitate the provision of relevant and verifiable data and information to the external valuer in relation to sustainability factors that may impact valuation outcomes.

Such information and data could include, but is not limited to:

The investment manager should ensure that the external valuer assesses the sustainability information provided to them and its relevant elements in the input assumptions to the valuation model.

Sustainability factors should be taken into account in current valuation models based on the market evidence to support their inclusion.

The investment manager should ensure that the external valuer summarises and discloses how the sustainability data and information have been taken into account in their valuation process.

Information provided should take account of the investment manager’s obligations to report under various regulatory requirements (eg Sustainable Finance Disclosure Regulation (SFDR), EU Taxonomy). Further guidance on the nature of information exchange between external valuers and investment managers may be included as part of recognised valuation frameworks.

In following the transparency principle (PV-P05) and its related guidelines, the investment manager should, in its reporting to investors, disclose whether sustainability factors have been taken into account when arriving at valuation outcomes.

The investment manager should report to investors whether sustainability factors were deemed material during the valuation process and to what extent they were reflected in market value.

Appendix 2 illustrates a range of potential qualitative and quantitative disclosures in relation to valuation inputs that could be materially impacted by sustainability factors.

The Property Valuation module assessment relates to the 2014 version. The assessment for the 2023 version is now available.

Please select the module(s) you would like to download