INREV Due Diligence Questionnaires (DDQ)

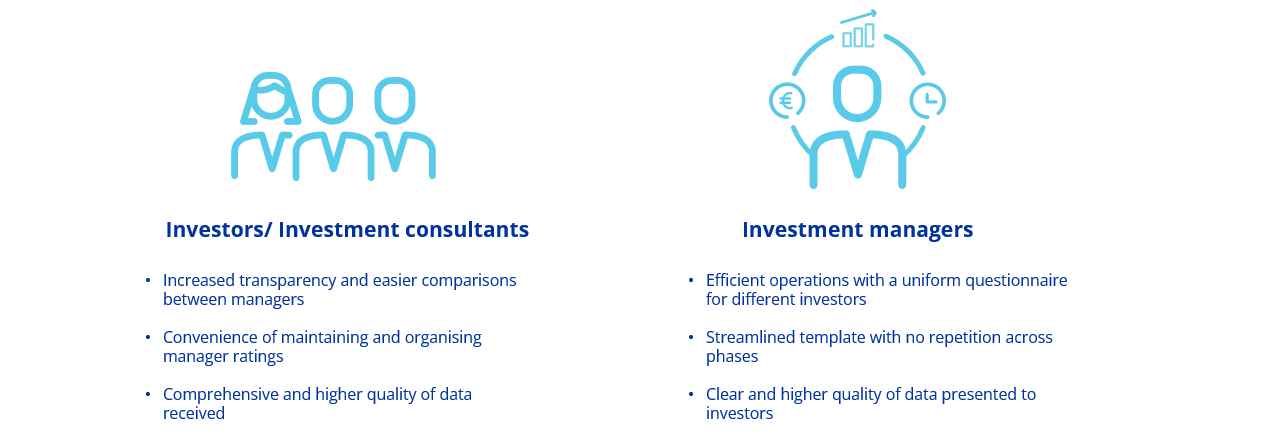

The INREV Due Diligence Questionnaire (DDQ) is a framework that allows investors to assess deals within a limited time frame while managing risks properly.

To encourage the standardisation of investor due diligence in non-listed real estate vehicles, the INREV Due Diligence Committee continually reviews the DDQ. New versions reflect the feedback from INREV members during a two-month consultation period.

DOWNLOAD

INREV Due Diligence Questionnaires (DDQ)

Published on 31 Oct 2023

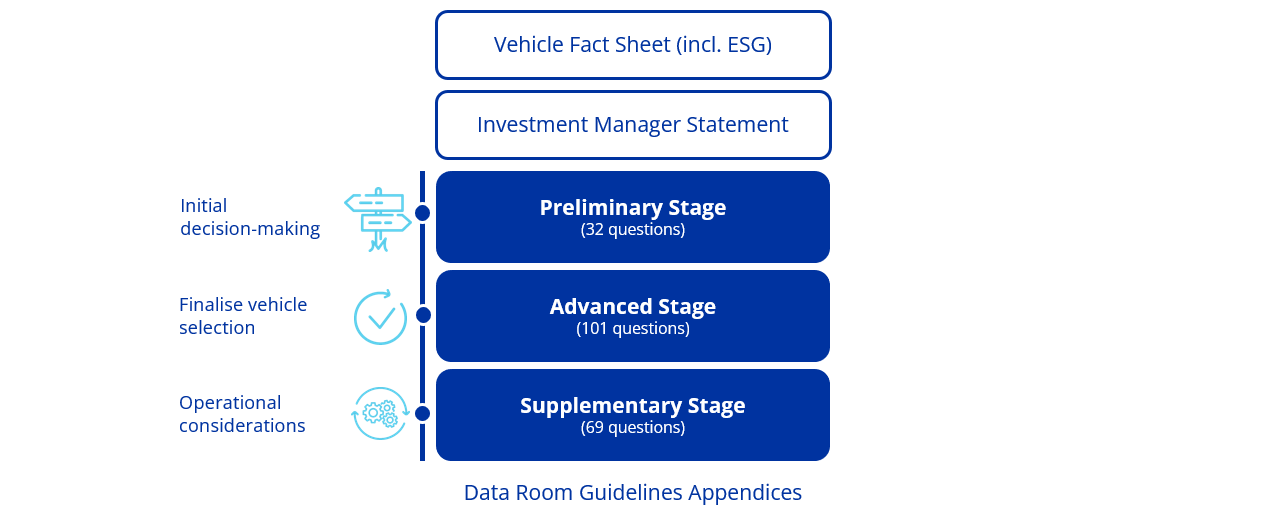

How is the INREV DDQ structured?

Who should use the DDQ??