Source: -

Source: -

Source: -

Source: -

No about page exists.

What does it cover?

The module includes guidelines for developing an ESG strategy for real estate investment vehicles and guides users on how to implement ESG best practices into their day-to-day operations.

When it becomes effective?

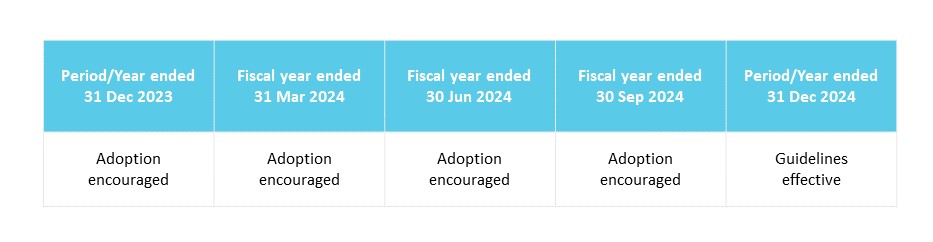

For vehicles to be compliant with this module, a transition period has been established. Investment managers and the governing body of the respective vehicle should assess and implement any organisational or reporting changes triggered by adoption of these guidelines during the period up to 31 December 2023. The guidelines will be applicable for reporting periods beginning on or after 1 January 2024. Earlier adoption is encouraged. Many of the guidelines reflect current industry practice and regulatory reporting which should enable partial or full adoption and compliance with this module as soon as possible.

How do you comply?

The Sustainability module is a best practice module:

Read more at INREV Adoption and Compliance Framework.

The INREV Sustainability module provides a generic framework for real estate investment vehicles to appropriately consider ESG goals, alongside other business objectives, as part of their overall strategy development. The module then guides users in implementing these goals through an appropriate governance framework established by the investment manager in collaboration with the governing body of the relevant vehicle. This involves establishing and empowering certain roles in an appropriate organisational model and embedding ESG considerations in key business processes. The module also emphasises the importance of effective and regular monitoring throughout the vehicle’s life.

As well as guiding users to implement ESG best practices into their day-to-day operations, the module also references a set of reporting requirements and recommendations as part of the INREV Reporting module, which promote transparency and a degree of standardisation across the industry from the point of view of investor reporting on ESG matters.

The overall process can be summarised by the following diagram.

These best practices and reporting guidelines were developed in order to meet growing investor expectations in this area as well as an acceleration in the pace of regulatory and business initiatives which aim to promote a more sustainable investment approach. In the development of the module as many of these regulatory and voluntary frameworks were considered to ensure the best possible alignment.

For instance, the guidelines include a reference table to other industry standards which are implemented in the real estate industry: GRI, UN PRI, GRESB and TCFD (see list of abbreviations in Appendix 4 under Tools and Examples). The references only intend to show the relationship between the INREV Guidelines and these other frameworks. The module and Appendix 5 also identify common areas which overlap with regulatory requirements but does not go as far as providing a comprehensive disclosure framework to comply with the relevant regulations.

The INREV sustainability guidelines can be applied to a wide variety of different vehicle types, including open end and closed end funds, as well as vehicles that apply specific sustainability frameworks to the conduct of their business and market themselves as such. Although there is significant degree of alignment between these other frameworks and the INREV Guidelines, compliance with these other frameworks, including current regulations, must be assessed independently.

From an operational point of view, real estate investment vehicles generally operate in an environment where the specific roles and responsibilities that support both strategic decision-making, as well as day-to-day operations, are allocated to a number of different parties, including external service providers. Many of the key ESG-related policies and procedures operate within the investment manager’s organisation, some or all of which may be adopted by the vehicle concerned. This typically results in complex and diverse governance models, which are reliant on an effective definition and allocation of roles and responsibilities among those concerned. While these guidelines do not mandate any specific activity to be undertaken by a specific function, the investment manager together with the governing body of the vehicle should ensure collectively that the governance structure is appropriate to effectively govern the vehicle from an ESG perspective in the best interest of its investors and other stakeholders. The structure of the governance framework, and how roles and responsibilities within it are allocated and applied to the vehicle concerned should be explained to its investors.

The INREV Sustainability module has been developed in conjunction with other relevant modules of the INREV Guidelines such as Property Valuation, Reporting, and Governance. For instance, the best practice guidelines are driven from the general principles established in the Governance module, tailored for specific ESG outcomes. In addition, many of the ESG performance indicators specified will become more important as key inputs in the property valuation process, as described in the Property Valuation module. Finally, the sustainability reporting requirements and recommendations are fully integrated into the Reporting module.

For more information, see INREV Property Valuation, Reporting, and Governance modules.

As with other best practice modules of the INREV Guidelines, at vehicle launch, the governing body of the vehicle, in collaboration with the investment manager and investors, should design an intended ESG framework that is adapted to the respective vehicle. As part of this process, the principles and best practice guidelines included in this module should be evaluated and adopted to the extent relevant to the vehicle and referred to in the constitutional documents as appropriate.

The governing body of the vehicle, in collaboration with the investment manager, should thereafter, periodically, perform a self-assessment against the intended ESG framework and take actions as appropriate. The level of adoption of the best practice guidelines and the annual score representing implementation effectiveness should be disclosed to investors in the annual report. This process is facilitated by using INREV’s self-assessment tool.

For more information see the Adoption and Compliance Framework of the INREV Guidelines.

The INREV Sustainability module was developed alongside the new sustainability reporting guidelines of the Reporting module which include a list of required and recommended disclosures that are categorised as follows:

If an investment manager chooses to adopt the recommended disclosures, the related data definitions should be followed. The recommended disclosures are voluntary and do not trigger non-compliance with the guidelines.

The INREV sustainability guidelines reflect the principles of the INREV Governance module.

Act lawfully and ethically

All parties involved in the operation of a vehicle should strive to meet the highest professional standards of ethics and integrity whilst complying with applicable laws. Acting ethically goes well beyond mere compliance with the law and written contracts.

Investment managers operate under a duty of care and should act ethically and with integrity towards investors and other stakeholders. Respect for the law and compliance with constitutional terms of the vehicle provide a basic framework against which the vehicle should operate. Acting ethically entails the investment manager, the governing body of the vehicle, and the other relevant actors understanding and adapting how they conduct themselves to ensure the achievement of desired long-term outcomes.

The INREV sustainability guidelines emphasise that acting lawfully and ethically requires the consideration of the impact a vehicle may have over its lifetime on the environment and the society in which it operates. Defining and including specific ESG-related goals in an overall vehicle strategy is a cornerstone of meeting these aspirations.

Act in the best interest of investors and consider other stakeholders

The investment manager should, in its actions, seek to maximise value for investors. Investors should clearly and actively express their expectations of the investment manager so that they can be duly considered and aligned.

The investment manager should also consider the interests of other stakeholders who transact and interact with the vehicle, such as tenants, lenders, and regulators. In addition, there are other categories of stakeholders related to the broader external environment and society that are covered by these guidelines.

Identifying and understanding the interests of stakeholders will vary from vehicle to vehicle.

In its actions, the investment manager should constantly strive to achieve alignment of interests with investors, while avoiding conflicts of interest that cannot be effectively managed. Alignment of interests between the investment manager and stakeholders creates shared values, expectations, and objectives and ensures commitment to a common purpose.

When establishing an investment vehicle, main goals such as portfolio strategy, investment horizons, and risk appetite should be clearly identified and understood by all parties. Methods of alignment that are specific to the vehicle structure, such as co- investment, performance and management fee models, as well as protocols around investor consultation and decision-making, should also be considered and implemented. Effective alignment ensures that risks and rewards are appropriately allocated between investors, the investment manager, and other parties, and that investors are treated fairly as a result.

The investment manager has a general duty to act reasonably, fairly, and transparently when balancing the interests of investors. As a general rule, while taking account of the interests of each individual investor, the investment manager should, as a priority, consider the impact of any decision on the interests of all investors collectively. The application of this principle requires judgment and has an ethical dimension as it could have an adverse impact on a minority of investors.

In considering the interests of investors and other stakeholders, the investment manager should take a long-term view regardless of the investment strategy, which may vary considerably from vehicle to vehicle. The culture, strategy, and operational approach of the investment manager should support appropriate long-term outcomes.

In the context of developing and pursuing a certain vehicle strategy, there should be a balance between financial returns and ESG outcomes which take account of the best interests of investors and other stakeholders.

Act with skill, care, and diligence

The investment manager should ensure that its activities related to investment vehicles are conducted prudently with diligence and care. It should also ensure that all parties involved, including its own personnel, the members of the governing body, and related service providers, behave with the highest standards of conduct and professionalism.

The investment manager should possess adequate knowledge, skills, and experience. It should constantly strive to apply best practices in arranging and supervising the business operations of the vehicle.

The investment manager should effectively engage with the governing body of the vehicle to enable it to effectively monitor its activities related to the vehicle. Acting with skill, care and diligence also means that the investment manager should refrain from engaging in any activity where it does not have or cannot secure the required expertise or capacity.

Monitoring and measuring ESG criteria require specific training and skills that should be developed across the organisation.

Design and operate an adequate oversight and control framework

The investment manager, in collaboration with the governing body of the vehicle, should design and operate an effective supervisory, decision-making, and control framework that adequately addresses the specific risks related to an investment vehicle. Such a framework, which extends to key service providers, needs the involvement of sufficiently qualified persons, who should possess the necessary skills and knowledge. In addition, the rights, obligations, and representation of investors, including their role in decision-making, should be clearly defined in the constitutional documents of the vehicle and respected.

The investment manager should ensure that its governance framework considers and is adapted to adequately define, implement and monitor specific ESG-related goals, risks and initiatives throughout the organisation.

Be transparent while respecting confidentiality considerations

The investment manager should be transparent and disclose information on a timely basis that is accurate, balanced, and clear. The investment manager should not only disclose information when there is a legal obligation to do so, such as when it is defined in the constitutional documents of the vehicle but should also proactively communicate and engage with investors and certain key stakeholders where the matter or information is considered relevant. At the same time, certain information regarding the vehicle and its investors that is not publicly available should be treated confidentially.

A vehicle should provide a complete and transparent summary of its ESG goals, organisational structure, and performance to investors.

Be accountable

The investment manager, together with the governing body of the vehicle and other related service providers, should be accountable to investors for the execution of their responsibilities given their roles and functions. This implies a duty of care, acceptance of scrutiny, and a reasonable level of liability.

The investment manager should specifically communicate on, and be accountable to investors and other stakeholders, in relation to ESG aspirations and performance.

The investment manager should ensure that the vehicle complies with applicable ESG laws and regulations.

The investment manager should comply with, and act in the spirit of, (i) the applicable laws and regulations relating to ESG issues (such as, SFDR, EU Taxonomy, CSRD, etc. (see list of abbreviations in Appendix 4 under Tools and Examples)) and (ii) the constitutional documents of the vehicle which may, among other things, adopt voluntary frameworks with respect to ESG issues such as GRI, TCFD, SASB, UN SDGs, UN PRI and others. Vehicles should also be prepared for any future legislation that may be undertaken over its life cycle.

The investment manager should have appropriate systems in place to monitor compliance.

The investment manager should develop and formally document its ESG strategy and objectives as a component of its overall goals related to the vehicles it manages, as relevant.

Acting ethically requires the investment manager to ensure that the overall goals of the vehicle consider and include a clear ESG strategy and objectives specific to that vehicle. The vehicle documentation should clearly outline these elements.

Building a practical and robust ESG strategy starts with a broad consideration of the ESG risks and opportunities that are material to the vehicle and its environment, including the society in which it operates over its lifetime, based on an appropriate materiality assessment. Consideration of recognised frameworks can support this process.

Furthermore, there are vehicles that are designed under various “impact investing” scenarios, subject to qualifying criteria that may be adopted. For example, refer to INREV’s definition and framework of Impact Investing.

The investment manager should identify and understand the interests of all major stakeholders with which the vehicle transacts and interacts (see also G07 of the Governance module). Regular consultations with these stakeholders, employees and relevant third parties may be helpful. The outcome should be clear ESG objectives that can be incorporated into the overall vehicle goals.

The consideration of an appropriate ESG strategy is an important element in the development of new vehicles. Depending on its strategy and objectives, an ESG strategy should also be considered and developed for an existing vehicle, to the extent feasible. Relevant considerations when building an ESG strategy are diverse and will vary over the lifetime of the vehicle. The relevance of the individual components needs to be monitored on a regular basis and specific objectives and planned outcomes adjusted accordingly. Factors to be considered as part of this process include but are not limited to those listed in Table 1.

The strategy should outline which ESG factors are relevant to the vehicle, the related vehicle-specific objectives and how these will these topics be monitored during its lifetime. The investment manager should clearly define in the vehicle documentation an outline of this strategic plan by reference to the specifics of the vehicle, including the location and type of assets and the nature of its operations.

Table 1: ESG Factors

| Key factors | Definition & explanation | Typical mitigation / operational actions | Required KPIs1-RG73 | Recommended KPIs1-RG78 |

|---|---|---|---|---|

| Environmental factors | ||||

| Energy Consumption / Renewable Energy | The portfolio’s total energy consumption, including the energy generated and/or sourced by renewable energy sources. | Monitoring energy use, implementing energy management system with new technology use (store energy, minimise artificial lighting), energy efficiency through products or systems using less energy (eg LED lighting), use of more efficient modes of transport etc. | ENV1, ENV2, ENV3, ENV4, ENV5, ENV6, ENV7, ENV8, ENV9, ENV10, ENV11, ENV12, ENV13 | ENV29, ENV30, ENV31, ENV32, ENV33, ENV34, ENV35, ENV36, ENV37, ENV38, ENV39, ENV40, EN41 |

| Greenhouse Gas (GHG) Emissions | Total GHG emissions of the portfolio, providing the details of the scope of the methodology used (eg direct / indirect emissions, embodied / operational carbon, market / location based, carbon off-sets etc.) (see INREV definition). | Changing energy source, through initiatives such as the use of lower-emission sources of energy, use of supportive policy incentives, use of new technologies, shift toward decentralised energy generation, decrease travel footprint. | ENV14, ENV15, ENV16, ENV17, ENV18, ENV19, ENV20, ENV21 | ENV42, ENV43, ENV44, ENV45, ENV46 |

| Climate Change – Transition Risks & Opportunities | Net zero building target, decarbonisation scenario pathway targets (see INREV definition). | Minimise the operational carbon (energy, water & waste), explore on-site renewable energy generation, procure off-site renewable energy (eg renewable energy certificates), minimise embodied carbon associated with capital goods, services, and capital works, neutralise residual carbon emissions by purchasing high quality carbon offsets. | ENV22 | ENV47, ENV48, ENV49, ENV50, ENV51, ENV52, ENV53 |

|

Climate Change – Physical Risks & Opportunities |

Climate adaption and resilience (see INREV definition). | Scenario analysis, physical measures at asset level. | ENV23 | ENV53 |

| Water Consumption | Portfolio’s total water consumption. | Initiatives to minimise water consumption (drip/smart irrigation, automatic water reading, high efficiency) and waste water management (reuse of grey water). | ENV24 | ENV54, ENV55, ENV56, ENV57, ENV58, ENV59 |

| Waste Management | Portfolio’s total waste generation, including issues associated with hazardous and non- hazardous waste, reuse, recycling, composting etc. | Use of recycling, reuse of waste generated during the operational phase of the building as well as considering circular building strategies in construction phase (eg use of renewable, sustainably managed and secondary resources which are low impact and eliminates waste across their life cycle). | ENV25 | ENV60, ENV61, ENV62, ENV63, ENV64, ENV65, ENV66, ENV67, ENV68 |

| Biodiversity | Impact of the portfolio on the variety of plants and animal species, covering issues related to wildlife, endangered species, ecosystem services, habitat management etc. | Initiatives to improve biodiversity (eg, green roofs) and protect green spaces and habitat. | - | ENV69 |

| Building Certificates | A measure of asset quality that may provide benefits for tenants, society and the environment. | - | ENV26 | ENV70, ENV71 |

| Energy Ratings | Indication of energy efficiency and performance of the assets. | - | ENV27, ENV28 | ENV72, ENV73 |

| Social factors | ||||

| Diversity, Equity and Inclusion (DEI) | In relation to the employment practices of the vehicle (or of the manager) and also in relation to engagement with suppliers and occupiers (see INREV definition). | Developing systems and procedures for recruiting and retaining diverse talent, ensuring equal pay for equal work, DEI trainings, supporting external diversity associations/activities etc. | - | SOC1, SOC2, SOC3, SOC4, SOC5, SOC6, SOC7, SOC8 |

| Health, Safety and Wellbeing (HSW) |

HSW initiatives of the vehicle (or of the manager) that involve both prevention of physical and mental harm, and promotion of stakeholders’ health. |

Flexible working hours/working from home arrangements, childcare facilities or contributions, paid maternity/paternity leave, indoor air quality/water quality, access to physical activity, social interaction and connection etc. |

- | SOC9, SOC10, SOC11, SOC12, SOC13, SOC14 |

| Stakeholder Engagement |

The process of involving stakeholders (tenants, community, suppliers etc.) who may be affected by the decisions made or can influence the implementation of the decisions. Engaging with stakeholders helps the manager identify and manage its negative and positive impacts. |

Stakeholder activities including tenant liaison, satisfaction surveys, training courses, green leases, community engagement strategy, processes to communicate grievances/complaints, feedback sessions etc. | - | SOC15, SOC16, SOC17, SOC18, SOC19, SOC20, SOC21 |

| Employee Development | In relation to working conditions for employees as well as in the supply chain. | Training courses, satisfaction surveys etc. | - | SOC22, SOC23, SOC24 |

| Human Rights |

Rights inherent to all human beings, whatever their nationality, sex, ethnic origin, colour, religion, language or any other status. These cover issues such as child labour, forced labour etc. |

Exclusion criteria for activities with third parties, green leases etc. | - | - |

| Social Impact | See INREV definition. | Affordable housing units, community engagement, car/bike parking spaces for residents/occupiers etc. | - | SOC25, SOC26, SOC27, SOC28, SOC29, SOC30, SOC31, SOC32, SOC33, SOC34, SOC35, SOC36 |

| Governance factors2 | ||||

| Act lawfully and ethically | ||||

| Act in the best interest of investors and consider other stakeholders | ||||

| Act with skill, care, and diligence | ||||

| Design and operate an adequate oversight and control framework | ||||

| Be transparent while respecting confidentiality considerations | ||||

| Be accountable | ||||

Notes:

1. See Table 1 of RG73 and Appendix 1 of the INREV sustainability reporting guidelines for the list of INREV ESG KPIs

2. For more details, please refer to INREV Governance module.

The investment manager should ensure that the vehicle’s ESG strategy and objectives include a climate change strategy to assess and manage climate-related risks and opportunities.

The investment manager should ensure climate-related risks and opportunities are included as part of its overall strategy. The investment manager should ensure that its operations are aligned with the long-term objectives of the Paris Agreement with respect to carbon emissions.

The vehicle’s climate strategy should include the definition of a science-based pathway specific to the vehicle, which is aligned with the overall goal of a transition to a low-carbon economy. This pathway should outline a reference base case and time horizon which has been stress-tested to reflect resilience against different climate-related and other scenarios and their potential impact on the financial performance of the vehicle.

Monitoring the vehicle’s performance against these objectives should be an integral part of its operations.

Refer to G07 of the Governance module.

The governing body of the vehicle, together with the investment manager, should ensure that there are systems and procedures to strengthen the skills, capacity and competence of employees and the governing body with regard to ESG issues.

The investment manager, together with the governing body of the vehicle, has a responsibility to assess whether the people involved in the vehicle are well-equipped and possess sufficient knowledge, skills, and experience to consider and address major ESG risks and opportunities while performing their duties.

Key members of the operational and management team, including the governing body of the vehicle, should have capacity and devote adequate time to effectively operate and oversee the ESG strategy and objectives of the vehicle. This consideration is especially important for team members that are instrumental to the success and execution of the ESG strategy of the vehicle.

The investment manager should ensure that all parties involved in the operations and management of the vehicle are adequately trained and have access to appropriate educational programmes in relation to ESG objectives of the vehicle.

It is important that all parties involved in the operations and management of the vehicle have an understanding of its strategy, objectives, and targets related to ESG considerations. This could be facilitated through training and awareness programs.

The investment manager should allocate sufficient resources for education and training. Training should cover the major considerations around ESG, including areas such as building an awareness of the impact ESG factors may have on the performance of a vehicle, its business model, and the risk management approach. Also, it should assist in identifying the primary impact the vehicle’s strategy has on the environment, society, and other stakeholders, together with its unintended consequences.

The investment manager should consider principles of Diversity, Equity and Inclusion (DEI) in shaping the structure and culture of its organisation, and the composition of its governing body.

The investment manager should ensure that its human resources processes and programs are impartial, fair, and provide equal possible outcomes for every individual based on merit, irrespective of identity and background.

The composition of the governing body should be based on the required skills and expertise and appropriate DEI principles.

The culture and management style of an organisation should promote effective teamwork with individuals feeling included and comfortable in contributing to problem-solving and decision-making.

The governing body, together with the investment manager, should define a framework for their oversight of ESG topics and their responsibilities for ESG factors in strategy-building, its implementation, and the investment process.

The governing body, together with the investment manager, should consider the following areas when defining their oversight framework and responsibilities with respect to ESG and climate-related issues and decision-making:

The investment manager should establish policies and procedures to ensure that the ESG strategy and objectives are implemented considering the best interests of its investors and stakeholders.

The investment manager should include in its policies and procedures provisions to effectively mitigate the potential impact that the vehicle’s operation may have on a range of external stakeholders with respect to ESG factors. For example, such considerations should be built into the vehicle’s due diligence and decision-making processes, to minimise material adverse impacts on society, the environment and other stakeholders, alongside the relevant financial and sustainability risks.

These policies and procedures should effectively address the range of ESG factors (listed in Table 1 of ESG02). A vehicle may have different approaches to documenting its ESG policies and procedures. For example, ESG objectives could be addressed through a series of dedicated policies (eg sustainable investment policy, responsible contractor policy, climate resilience policy, conflicts of interest policy etc.) or could be embedded in relevant wider business policies (eg as a component of human resource policies or investment policy etc).

The remuneration policies for members of the governing body and for the investment manager should be consistent with the ESG strategy and relate to objectives and performance in relation to the management of ESG risks and the vehicle’s impacts on the environment and society.

The ESG policies and procedures should be practical and embedded in key business processes, such as supply chain management, building operations and development (including adaptation and mitigation activities), acquisition/divestment activities, and access to capital.

The investment manager should design and operate an effective system of internal controls on its ESG framework.

An effective internal control framework should be adapted to the specific risks, processes, and organisational structure supporting an investment vehicle. It should include consideration of the ESG framework of the vehicle. The investment manager may consider developing an Environmental Management System (EMS) for the vehicle and/or for its property management activities and having certified it, to the extent it is applicable.

The internal control framework should be aligned with legal and regulatory compliance functions and the overall risk management framework (for more details, see Governance module).

The investment manager should identify key metrics, in order to monitor progress towards ESG objectives and annual targets, including specific climate-related outcomes, on a regular basis.

Environmental and social objectives should be measured and monitored by setting clear metrics. These indicators should be designed to measure and manage ESG risks and opportunities and be aligned to the extent possible with INREV’s list of standardised metrics typically used for real estate investments, as described in Table 1 of RG73 and Appendix 1 of the INREV sustainability reporting guidelines.

These metrics include indicators related to climate risks, energy efficiency, water consumption, waste management and biodiversity, as well as social metrics, where relevant.

The investment manager should define specific positions, teams and/ or committees, embedded in their management structure, to coordinate and monitor progress towards objectives that are defined within the ESG strategy.

The investment manager should define specific roles and responsibilities, embedded in their management structure, to ensure that the implementation of the ESG strategy is efficient and effective, including, but not limited to:

The investment manager should develop a framework to identify and track ESG-related incidents and controversies in an effective and timely manner.

In the normal course of business, a vehicle may encounter and be exposed to a wide range of ESG-related incidents and controversies such as misconduct, penalties, accidents, and breaches of codes of conduct/ ethics. The investment manager should ensure it has sufficient resources and systems to identify, monitor, and resolve such ESG- related incidents and controversies in an effective and timely manner.

The investment manager should ensure that, as an integral part of the investment process, adequate ESG assessments and analyses are fully embedded.

When making key decisions, such as to develop new buildings, refurbish assets, and/or buy/hold/sell assets, it is important to fully analyse and understand specific ESG factors related to the asset and how these factors were taken into account, including assessments on valuation outcomes (for more details see INREV Property Valuation module). The investment manager should be confident that they have done sufficient work to confirm that a particular asset and its related asset management plan are aligned with its overall ESG strategic objectives – see Appendix 2 for a list of ESG considerations related to important components of a typical investment process.

The investment manager should ensure that its ongoing asset management processes are aligned with the overall ESG goals and objectives of the vehicle.

To achieve the ESG objectives of the vehicle, the investment manager should define annual plans at the asset level and set out clear ESG targets and action plans associated with the management of the asset. It is important to identify key performance indicators for the assets in order to monitor progress towards those objectives on a regular basis. The investment manager should consider the ESG KPIs set out by INREV – see Table 1 of RG73 and Appendix 1 of the INREV sustainability reporting guidelines.

The investment manager should consider an appropriate management system to collect and consolidate ESG data related to the vehicle and its underlying assets, including tenant and supply chain data.

The investment manager should also consider incorporating ESG clauses into lease agreements to support the ESG objectives. ESG clauses relate to actions such as, defining the responsibility for capital expenditure on ESG projects, sharing cost savings, sharing data and the installation of energy and water metering, making commitments that ESG factors will be considered when using contractors, etc.

The investment manager may participate in ESG assessments and/or receive ESG scores. In addition, tenant engagement strategies play an important role in implementing an ESG strategy at asset level. Tenant engagement actions may include training, regular meetings, campaigns and surveys.

The investment manager should build systems and processes to manage ESG impact in their supply chain.

An investment vehicle may be involved in negative ESG impacts either through its own activities and assets or as a result of indirect impacts through its supply chain.

The investment manager should consider the main drivers of any possible negative ESG impacts it might have in its supply chain and build its approach to prevent and mitigate them.

The investment manager should consider ESG factors in its due diligence in order to prevent, mitigate and address actual and potential negative impacts in the supply chain. These include negative impacts caused by the relationship with a supplier that could be directly linked to the operations, services or development of the assets.

Actions taken to address supply chain impact can include changing procurement practices and other processes and adjusting performance expectations and training, as well as terminating certain supplier relationships.

They may also include operating programs to engage with other stakeholders, such as the communities related to the operation of specific assets, to enhance performance, and identify and mitigate actual or potential negative impacts.

As part of the development of the vehicle’s overall risk management framework, the investment manager should ensure that ESG risks, including climate-related risks, are appropriately identified, assessed, and monitored.

The vehicle risk management framework should include a definition of relevant ESG- related risks and risk appetite. It should also define the roles, responsibilities, and controls within the risk management function which specifically mitigate those risks.

The investment manager should ensure that ESG-related risks and mitigation strategies are integrated into the investment objectives and operations of the vehicle.

See Appendix 1 for a description of ESG considerations and techniques that may be considered by risk managers.

The investment manager, in collaboration with the governing body of the vehicle, should define an appropriate ESG reporting framework. This framework should be clear, balanced, and fairly represent the ESG performance of the vehicle, in line with regulatory requirements, investor expectations, and its ongoing business needs. The framework should be clearly defined in the constitutional documents of the vehicle.

The investment manager, together with the governing body of the vehicle, has an obligation to ensure that all forms of reporting, including ESG reporting, are appropriate to the circumstances and include applicable regulatory and legal components. In pursuing this responsibility, the best interests of investors should always be considered. See also G31 of the Governance module.

The investment manager should disclose relevant ESG information periodically (at a minimum on an annual basis) in a clear and concise manner. In accordance with INREV’s reporting guidelines, the investment manager should clearly define in the constitutional documents of the vehicle the content, frequency, and timing of its annual and interim ESG reporting (see also G37 of the Governance module. These should be determined in line with investor expectations and the ongoing business needs of the vehicle.

The organisation and reporting format of the vehicle’s ESG status, actions and performance may be reflected in a dedicated ESG section in annual/interim reports, integrated into relevant generic sections of those reports, or presented as a standalone sustainability report (see Reporting module).

When developing its ESG reporting framework, a broad range of ESG KPIs should be considered by the investment manager as relevant to the ESG strategy and business needs of the vehicle - see INREV ESG KPIs in Table 1 of RG73 and Appendix 1 of the INREV sustainability reporting guidelines.

In addition to respecting the regulatory and contractual reporting obligations of the vehicle, the investment manager may consider other widely recognised ESG reporting standards and frameworks. The investment manager should disclose to investors which industry frameworks were considered and adopted for ESG reporting and climate-related risk assessments (eg TCFD, WGBC ANZ, GRI, SASB, CDP, UN PRI, UN SDG (see Appendix 4)).

The investment manager should state whether the vehicle participates in ESG assessments and/or receives ESG scores (eg GRESB). Information regarding participation, outcomes/scores and future ambitions should be communicated to investors.

ESG reporting should include details on how the vehicle embeds the ESG strategy into its overall governance approach to achieve targets and the performance achieved against those targets. It should include a description of how its governance structure integrates ESG considerations into decision-making processes.

Certain legacy vehicles or funds which opt not to have a coherent ESG reporting framework should nonetheless disclose this status and provide any relevant explanations.

The Investment manager, together with the governing body of the vehicle, should demonstrate how they are actively engaged with and accountable to their stakeholders.

The investment manager and the governing body of the vehicle are accountable to their stakeholders for the ESG strategy and performance of the vehicle. Demonstration of this accountability could include, for example, being prepared and ready to respond to ESG- related queries, providing explanations on the ESG performance of the vehicle, or meeting with investors and other stakeholder groups to review and discuss ESG-related issues impacting the vehicle.

For more details on the accountability principle and guidelines, see the INREV Governance module.

The Sustainability reporting assessment relates to the INREV Sustainability Best Practice Recommendations from 2016. The assessment for the Sustainability module (2023) is now available.

Please select the module(s) you would like to download