Trends in Investor Reporting

Published bi-annually since 2015

Welcome to the Trends in Investor Reporting study, an insight into current market practices in investor reporting across non-listed real estate vehicles investing in Europe, and specifically the extent to which reporting complies with the requirements and recommendations of the INREV Guidelines.

The study aims to measure the fund compliance with the INREV Guidelines across the Reporting, Property Valuation, INREV NAV, Fee and Expense Metrics, Performance Measurement and Sustainability modules as well as a separate Investment Manager Profile section.

DOWNLOAD

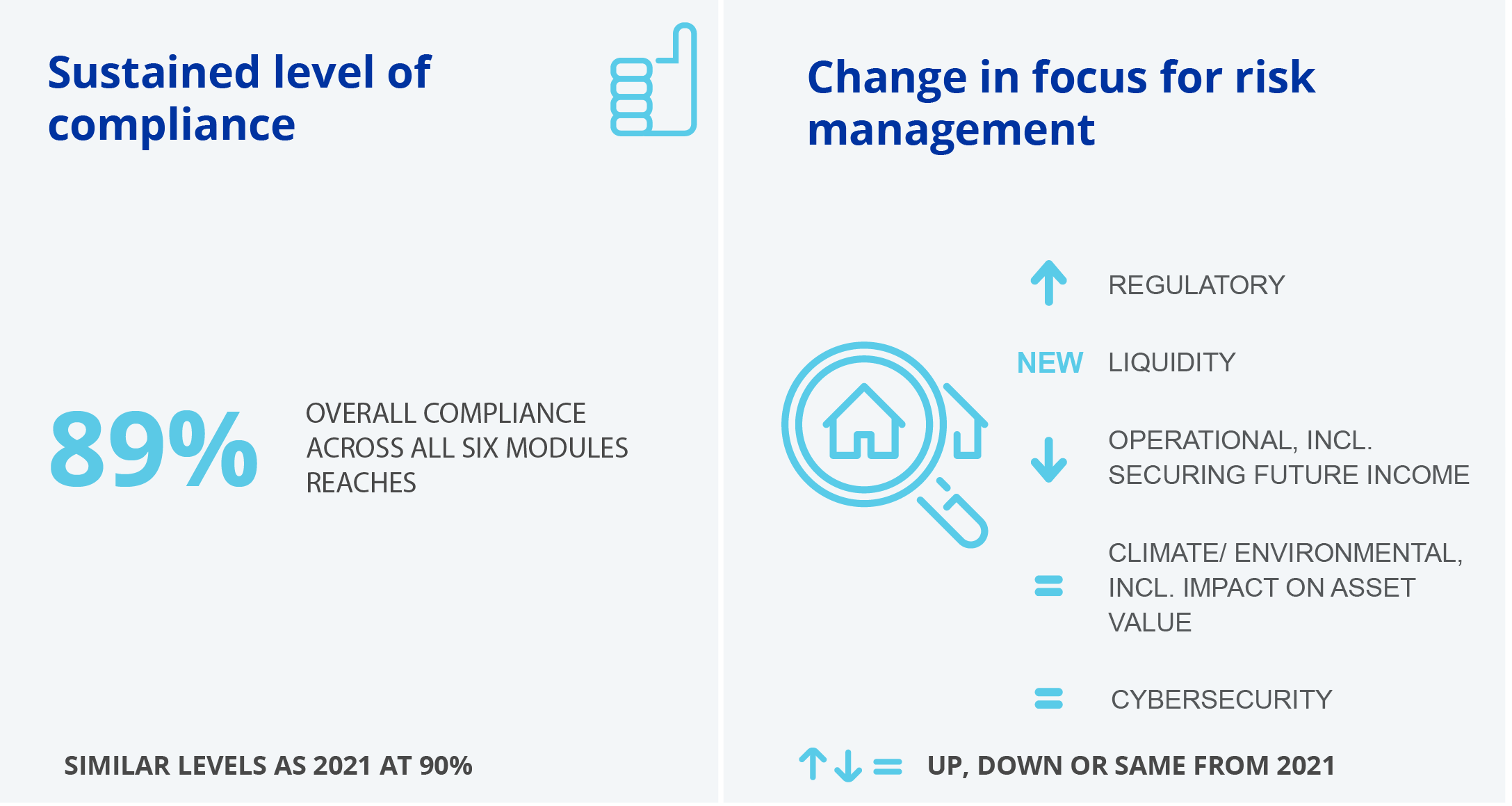

The 2024 INREV Trends in Investor Reporting study reveals a sustained level of adherence to INREV Guidelines, driven by enhanced reporting practices and a growing focus on ESG considerations.

- The overall average compliance rate across modules reached 89%, similar to 90% in 2021.

- Compliance for the Sustainability module reached 98%, the highest across all modules, and significantly improving from 85% in 2021 for the recommended sustainability guidelines, reflecting broader reporting in the ESG space.

- Open End Core European Institutional non-listed real estate funds (ODCE Index funds) accounted for about 30% of participants, with compliance scores matching the overall sample at 89%.