Real estate debt funds

The European non-listed real estate debt funds sector is undergoing a rapid transformation, with increasing demand as investors seek to expand their portfolios and enhance returns. Shifting market conditions, marked by a 'higher for longer' interest rate environment, have led to a further rise in non-traditional lenders filling the void left by traditional banks, resulting in a more diverse lending landscape.

Debt Funds | Highlights

Debt Funds Committee

The Debt Funds Committee will be launched in January 2026, playing a key role in enhancing transparency, consistency and thought leadership in European non-listed real estate debt. Learn more about the committee’s goals and what projects are in the pipeline.

Size and characteristics

The INREV Debt Vehicles Universe includes information on debt vehicle characteristics such as loan strategy, size, domicile, structure and vintage. Today it represents €72.6 billion total target equity, spread across 131 vehicles. A snapshot of the universe is published every year in October.

The latest highlights show:

Favourable market conditions have pushed European non-listed real estate debt funds to a record €72.6 billion in target equity, doubling their 2016 level.

Over 80% of the €72.6 billion target equity is in closed-end structures, with senior debt being the most popular loan strategy (60%).

Debt funds launched in cohorts coming out of the Global Financial Crisis target higher IRRs than funds launched in more recent years.

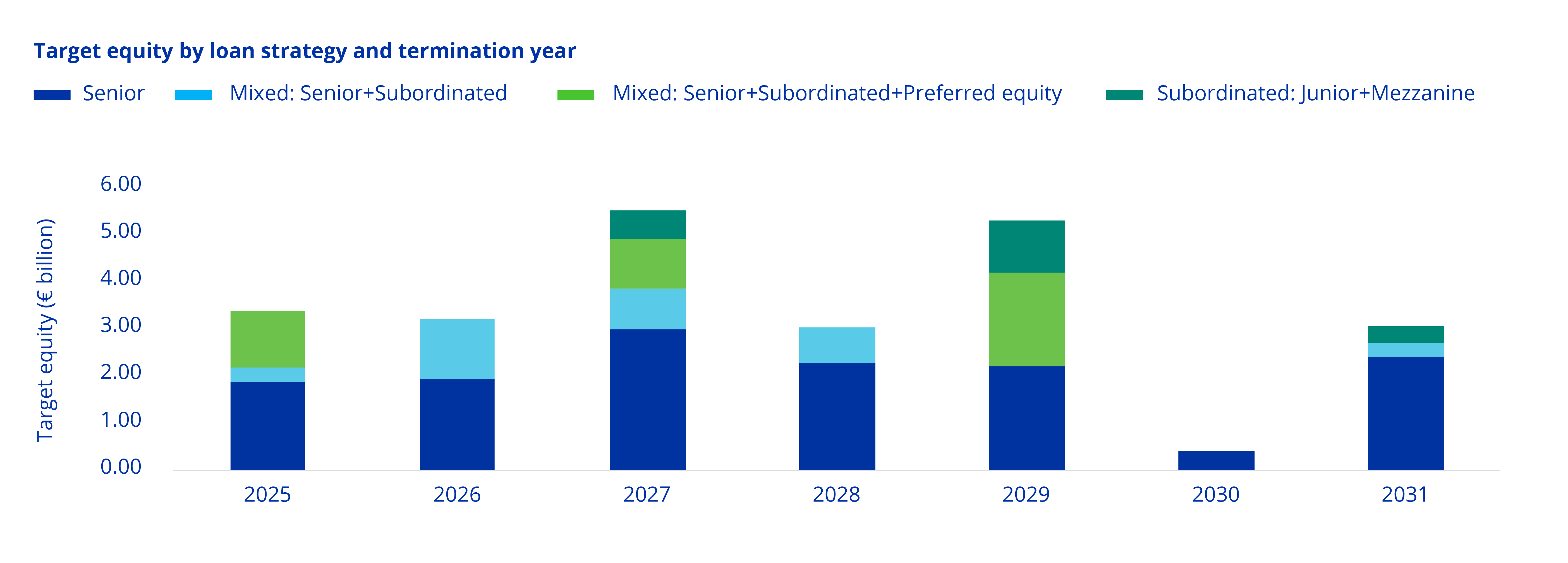

Funds with vintages from 2015-2022 comprise 87% of the €23.9 billion worth of real estate debt expected to come to market in the next six years.

Growth opportunities in European Real Estate Debt

The European non-listed debt market has experienced substantial growth, more than doubling in size from 50 vehicles and a target equity of €30 billion in 2016 to €73 billion in 2025. This growth is particularly pronounced as traditional lenders exercise caution due to stricter banking regulations.

Simultaneously, high regulatory capital requirements have increased operational costs, creating an opportune space for European debt funds to thrive. This evolution is further fueled by a funding gap, with an anticipated €36 billion of assets from closed-end fund liquidations alone expected to come to the market in the next decade. The broader market estimate expects around €94 billion (AEW Research Monthly Report August 2023).

Do you have a debt real estate vehicle that you want to promote?

Here's two ways to do that:

- Contribute to the INREV Debt Vehicles Universe

Debt Vehicles Universe

- Showcase your debt fund in the bi-weekly INREV Industry News

Send news

Debt chart of the month