28 May 2024

Latest highlights

Columns

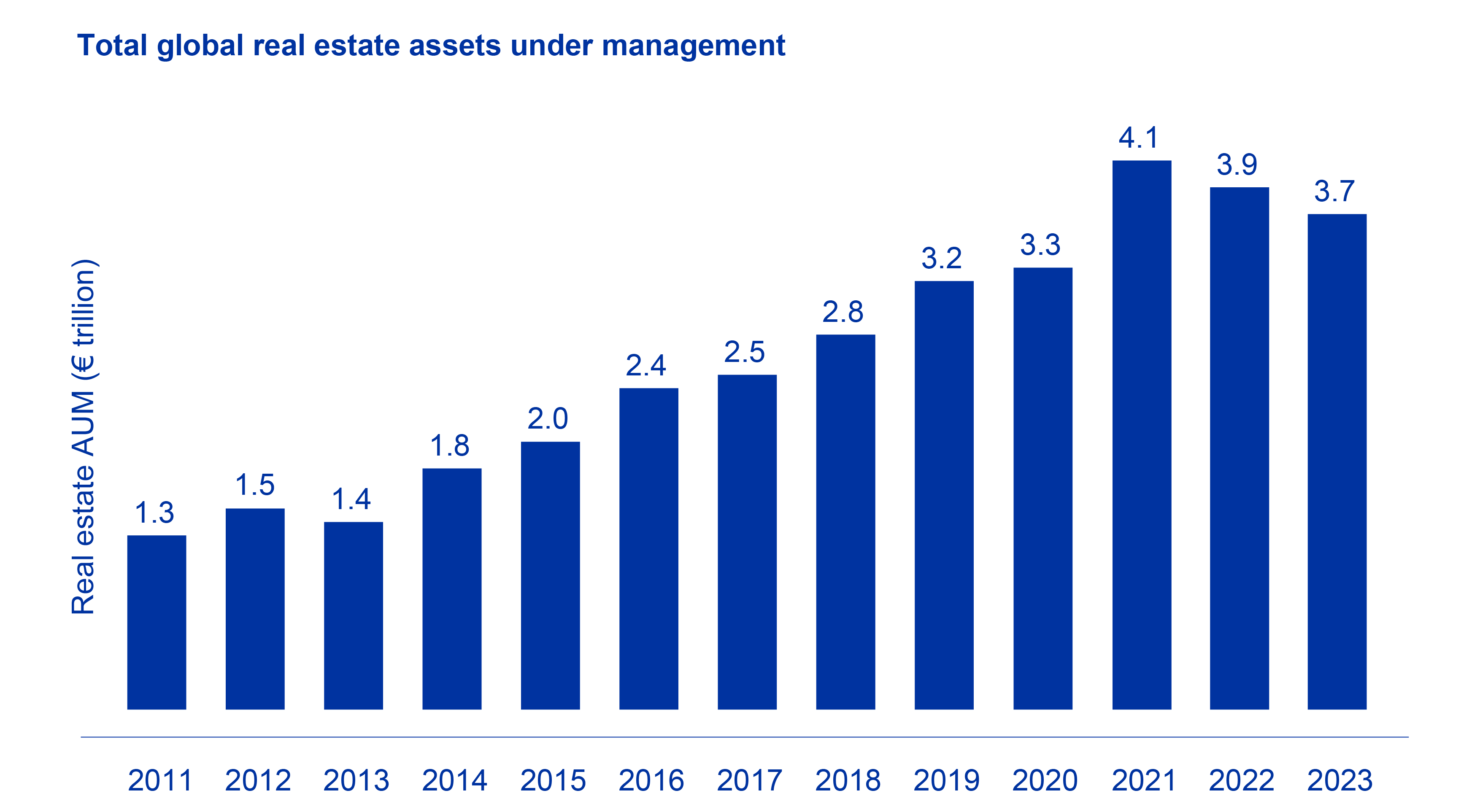

Global real estate AUM falls to €3.7 trillion

Key highlights include:

- Concentration of capital in the upper quartile continues. The fund managers in the upper quartile accumulate around 79% of the total global real estate AUM.

- Top 10 RE managers reported an average AUM of €189.6 billion, a 2.9% increase on the €182.6 billion equivalent at the end of 2022.

In the press

30 May 2024 - REACT news

Inrev's latest fund manager survey highlights an increase in available capital

29 May 2024 - EG

Total global real estate assets under management has fallen for a second consecutive year on the back of market repricing, according to new research.

29 May 2024 - Immobilien Zeitung

Nur noch die größten Immobilienfondsmanager der Welt konnten im Jahr 2023 ihre Assets under Management steigern. Die gesamte Branche der Fondsmanager ist hingegen leicht geschrumpft, wie die drei Fondsverbände Inrev, Anrev und Ncreif ausgerechnet haben.

29 May 2024 - PropertyEU

INREV has said a total of €223 bn of dry powder among investment managers globally could lead to a rapid uptick in investment flows as the gap between willing buyers and sellers ‘continues to shrink’.

All press releases