SDDS (Standard Data Delivery Sheet)

Standardised data delivery puts everyone on the same page.

The multitude of data formats used in the market can mean inefficient data handling and administrative overload. Since its first release in 2012, the Standard Data Delivery Sheet (SDDS) has helped by providing a common reporting format for investment managers and investors to exchange information. This creates uniformity, transparency and operational efficiencies between both parties.

The sheet’s latest update, SDDS 4.0, is aligned with the latest industry developments and changing investor needs, to ensure it remains practical and useful in today’s market.

INREV has also introduced the ESG SDDS, a brand new ESG reporting template designed to standardise the disclosure reporting of ESG Key Performance Indicators (KPIs) for real estate investment vehicles.

What is the SDDS?

The INREV SDDS is a template designed to standardise the main quantitative components of reporting data to investors, while providing more consistency and comparability.

The most recent update to the sheet was made in November 2023, establishing the INREV SDDS 4.0.

![]()

Latest publications and downloads

The sheet’s latest update is aligned with the latest industry developments and changing investor needs, to ensure it remains practical and useful in today’s market. Below you will find the latest version of the template, SDDS 4.0, updated in November 2023.

If you would like to access the unprotected version of the SDDS, please send your request to Professional.Standards@inrev.org

Who should use the SDDS?

![]()

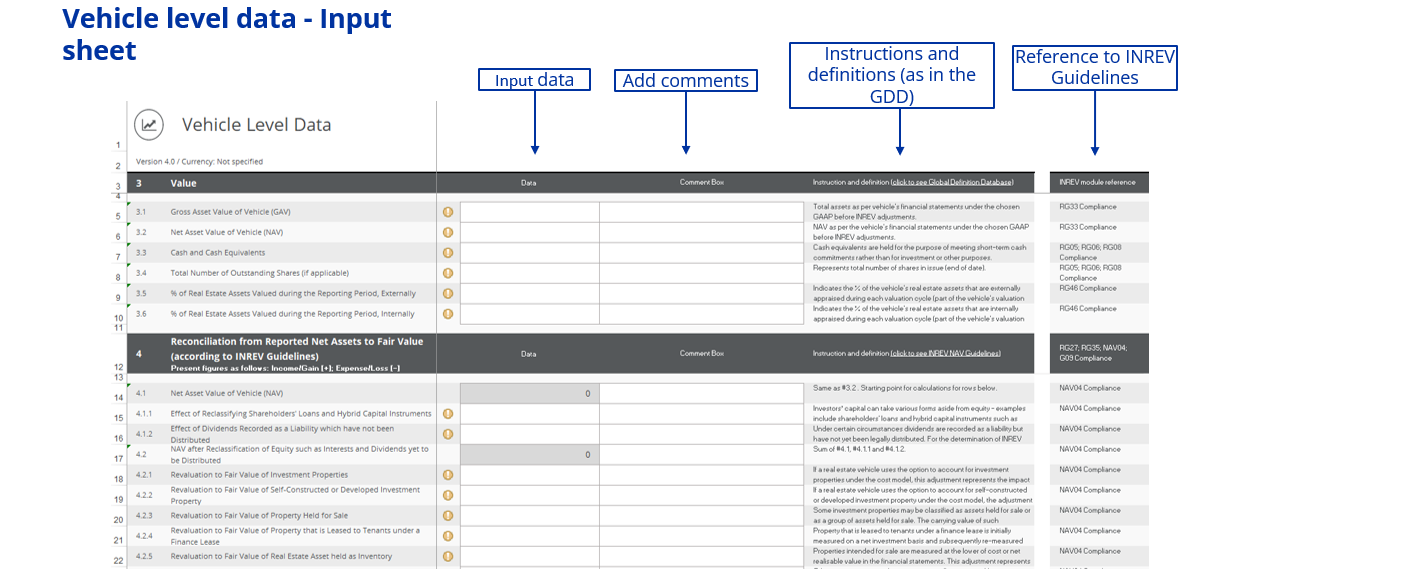

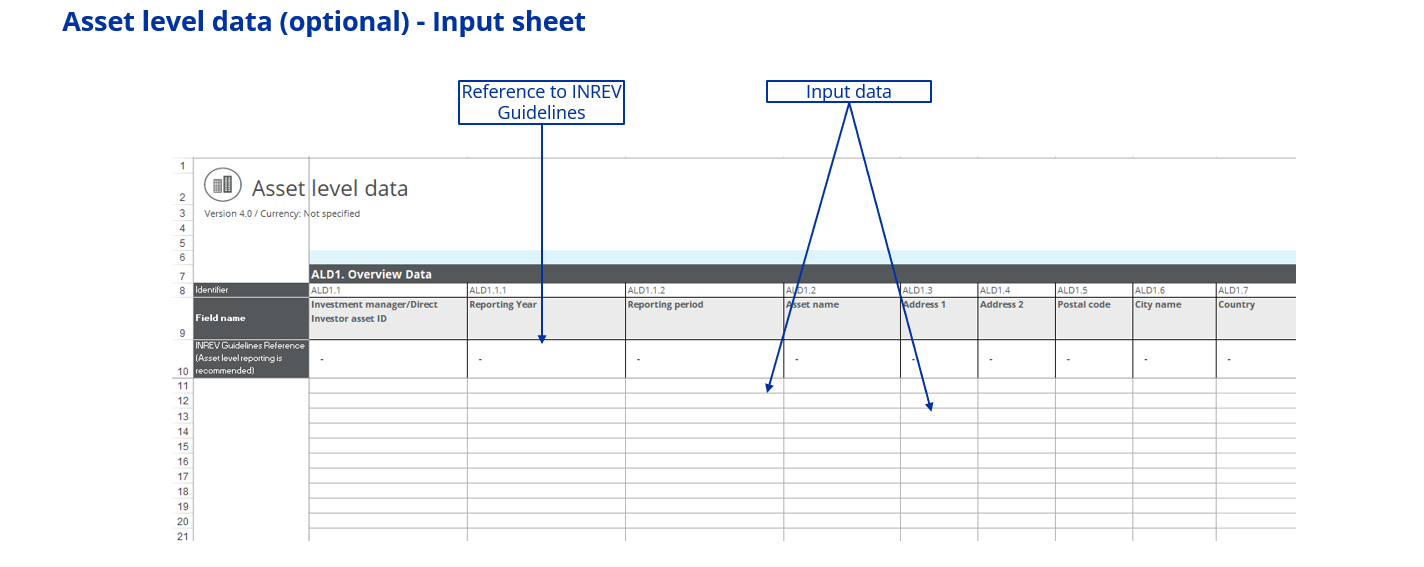

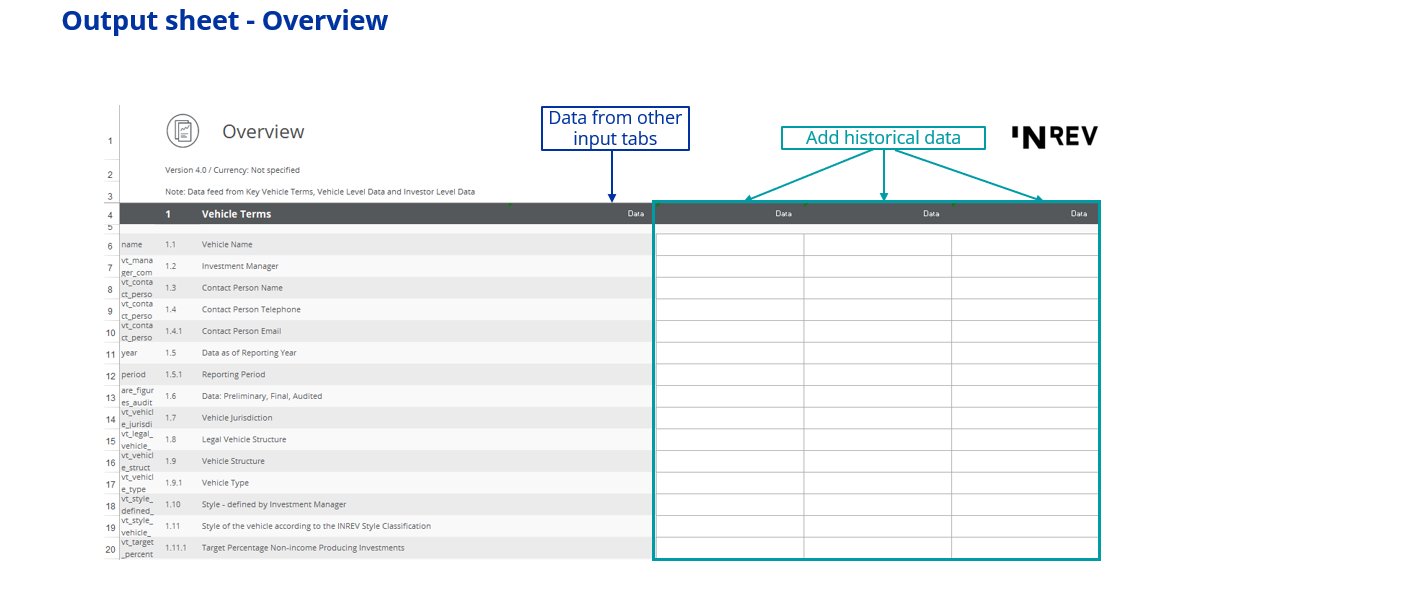

How to fill in the INREV SDDS 4.0

What members say

| 'The enhanced INREV SDDS facilitates the seamless exchange of critical investment data, presenting a standardized template that optimizes operational efficiency for investment managers and investors alike. Leveraging this updated delivery sheet promises a tangible reduction in administrative burden, while its adherence to INREV Guidelines ensures a uniformity that fosters clarity and consistency in data transmission, ultimately enriching the experience for all stakeholders involved.' Emanuela Sardi, Partner | |

| ‘The updated INREV SDDS 4.0 represents a significant leap forward in the standardization of real estate investment data, providing a comprehensive framework for transparency and comparability. The inclusion of the asset level data tab is a game-changer, enabling investors and managers to drill down into the granularity of their portfolios, thus ensuring a deeper understanding of their investments. This level of detail empowers better decision-making and enhances the strength of reporting, ultimately driving the industry towards greater alignment and efficiency. From an audit perspective of auditing ultimate investors, investing in real estate vehicles, we use the SDDS 4.0 for our detailed understanding of the specific investment vehicle, underlying portfolio, risk assessment and detail analytical audit procedures and audit testing.’ Jef Holland, Partner | |

| 'Using the INREV SDDS has helped us drive standardisation within the business and deliver consistent, high quality data to investors. The new template addresses gaps that have become important to our clients as well as introducing the asset level template which is critical if we, as managers, are to provide meaningful data investors can aggregate.' John Fahey, Managing Director, Fund Finance | |

| ‘As an INREV reporting committee member, I am delighted to see the new INREV SDDS fully aligned with the latest INREV Guidelines and global definitions, which we’ve been working on. Introduction of the asset level data section, which I highly recommend to adopt, is a massive step forward to help investor get standard and comparable information at the property level. Pavel Nesvedov, Partner |

Watch the video below to hear how CBRE Investment Management uses the INREV SDDS to streamline their reporting process.

Change Log

Below you will find a Change Log of the SDDS, which includes a direct comparison of the updates made to the SDDS 4.0. All updates and new items have been marked using a light-blue highlight.