Does European property offer inflation protection?

It depends...

The war in Ukraine and the resulting energy crisis has brought a higher interest rate and inflation environment back to Europe. With high inflation seemingly a historical phenomenon, many of the younger market participants are experiencing and learning how to adjust their decisions in a high inflationary environment for the very first time.

Inflation is notoriously challenging to forecast. Analysis over the last 20 years shows that, 24 months or more prior to a forecast year, the consensus tended to forecast CPI in line with the European Central Bank 2% target while catching up with actual figures as the forecast year came to a close.

With high inflation seemingly a historical phenomenon, many of the younger market participants are experiencing and learning how to adjust their decisions in a high inflationary environment for the very first time

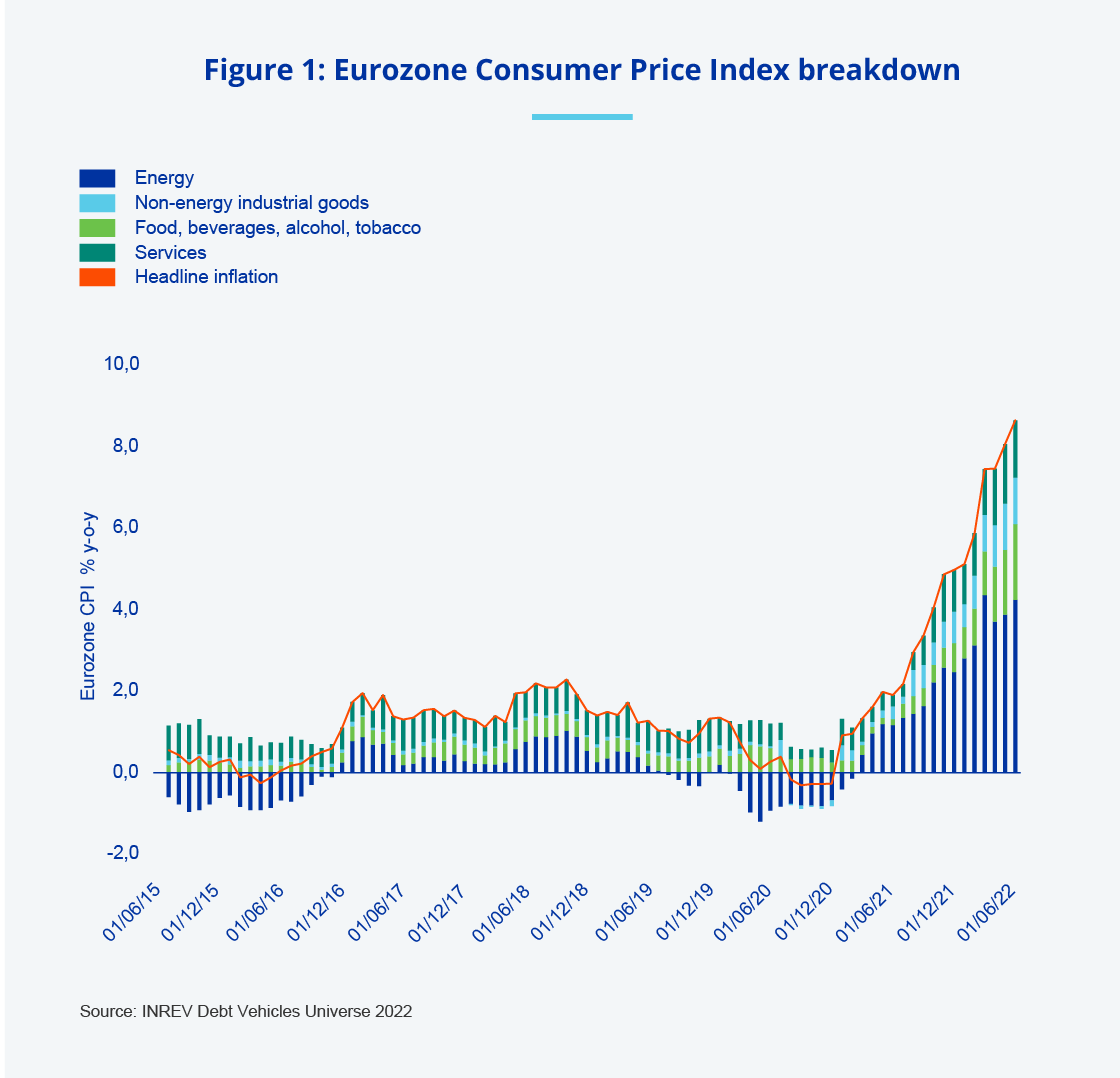

In 2022 however, Eurozone CPI reached 8.6% in June, well above the 1.9% 30-year average, fueled by increasing oil and gas prices. A closer look at the breakdown of inflation drivers shows that the strength of inflation is driven by components beyond energy suggesting other factors are at play (Figure 1).

Figure 1: Eurozone Consumer Price Index breakdown

Source: Capital Economics Q2 2022

Over the next 12 to 24 months, CPI is expected to be driven by higher services inflation as eroding real incomes give rise to higher wage negotiations. In response, the ECB raised interest rates by 50bps, a sharper rise than what had been announced. But with central banks unfamiliar with managing this type of cost-push inflationary environment in recent history, the accuracy of inflation forecasts is likely to get worse.

More pertinent to our industry, investors are currently questioning to what degree the real estate asset class offers inflation protection. There is a widely held view that property provides inflation protection by growing income while at the same time eroding the value of debt used to finance transactions. However, empirical evidence shows that this is an oversimplification that requires qualifying.

There is a widely held view that property provides inflation protection by growing income while at the same time eroding the value of debt used to finance transactions

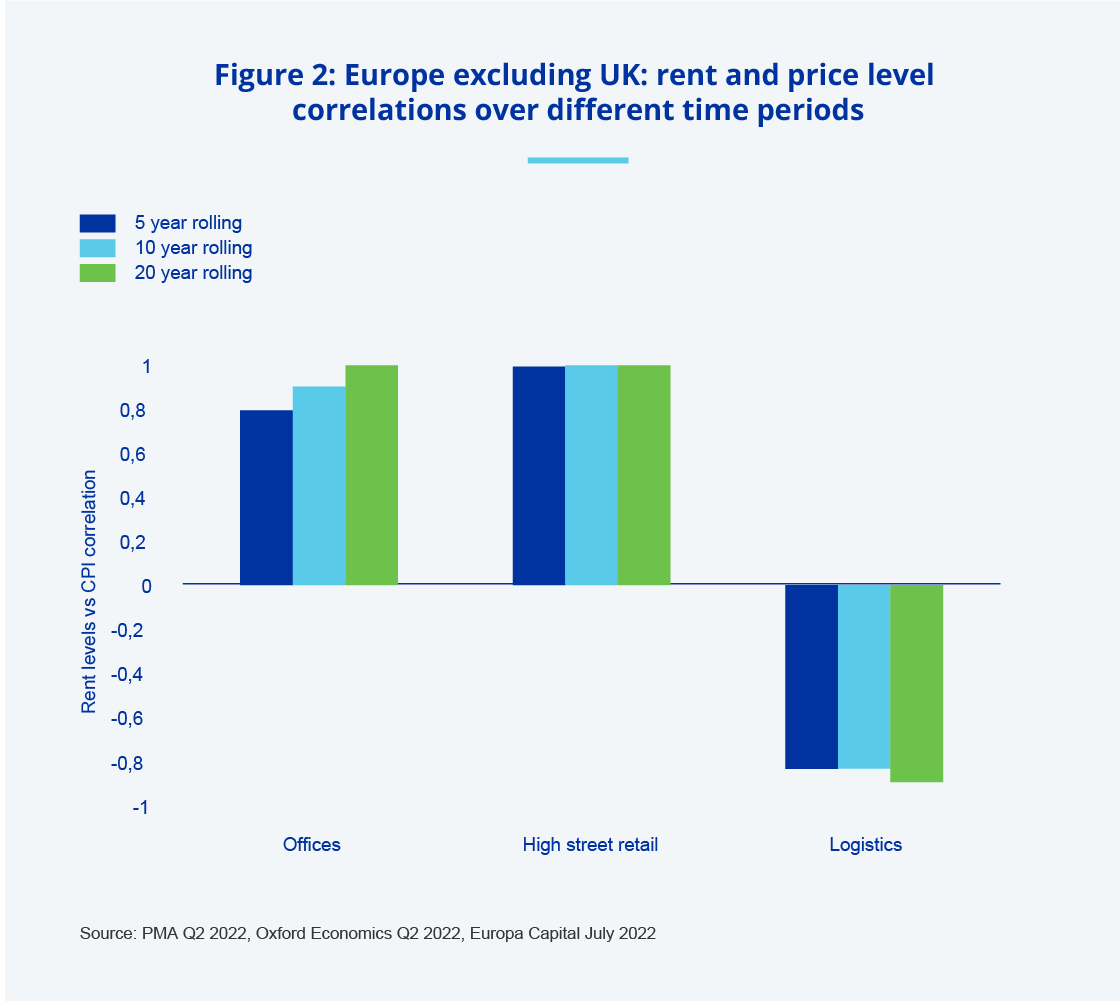

Sector and time horizon

The figure below shows the correlation between CPI and rents across sectors and short- to long-term time periods. Offices and high street shops have provided better inflation protection with longer time periods (20 years), offering the best results. Conversely, the logistics sector was held back by its supply elasticity. However, as the pressure to hold more inventory continues into a post pandemic / de-Globalisation era, agents report that logistics occupiers are moving into secondary space as insufficient ‘modern’ stock is delivered to the market . Looking ahead, these favourable structural drivers point to the order of inflation protection shifting, with the logistics sector moving up the ranking.

Source: PMA Q2 2022, Oxford Economics Q2 2022, Europa Capital July 2022

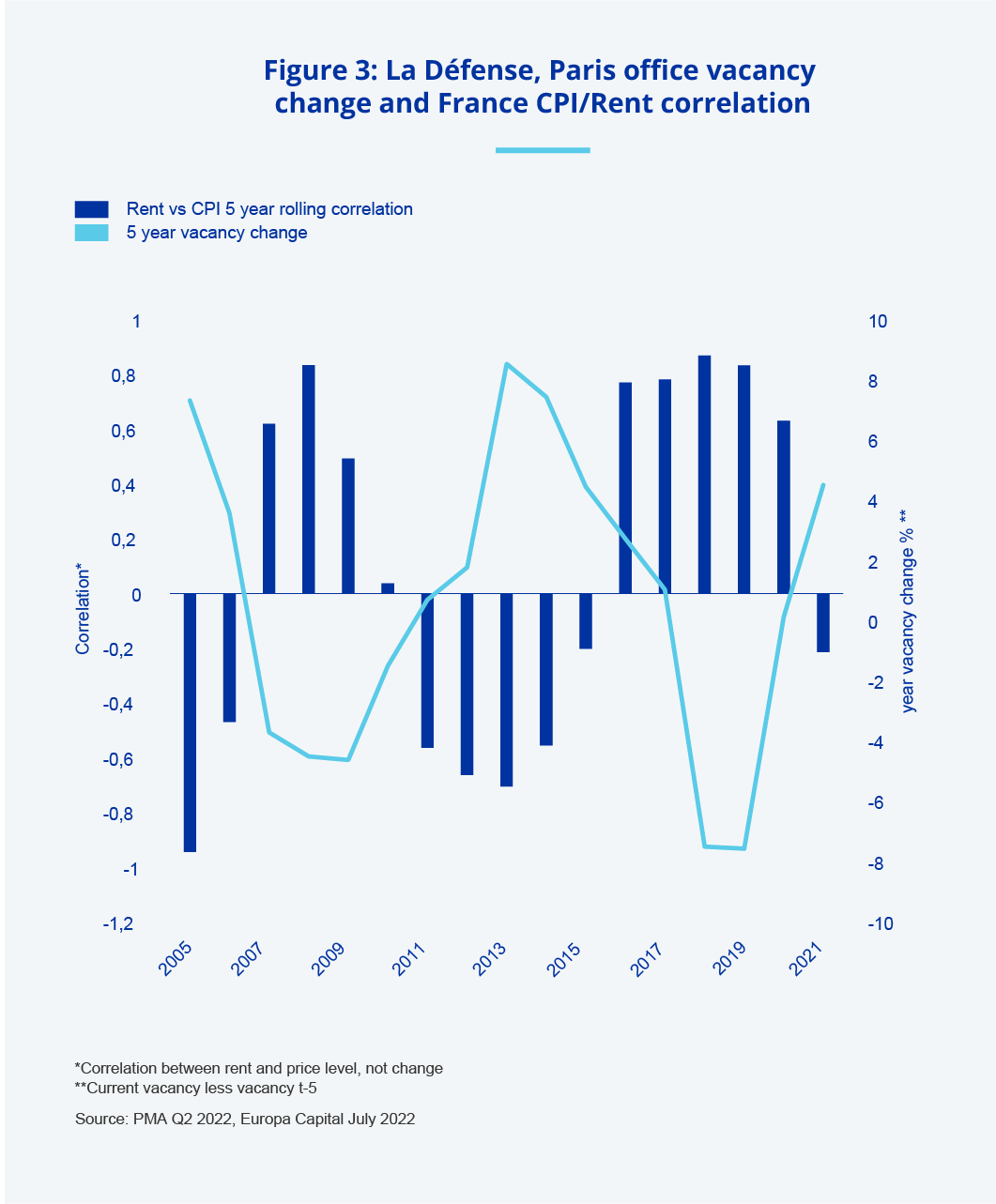

Sort term supply/demand imbalance

In the short term, the tighter the supply/demand imbalance within a market, the higher the degree of inflation protection. Using La Défense office market as an example, the below chart shows a greater correlation between rents and inflation when vacancy is low and vice versa when vacancy peaks (Figure 3).

*Correlation between rent and price level, not change **Current vacancy less vacancy t-5

Source: PMA Q2 2022, Europa Capital July 2022

Type of inflation

Arguably, the bigger threat to real estate providing inflation protection today, is the type of inflation experienced in Europe. Cost-push inflation provides protection while leases are in place. CPI-linked leases benefit from inflation, regardless of the source (subject to any cap and collar). Once the lease ends the rent reverts to market, with the new contracted rent determined by supply and demand.

In the short term, the tighter the supply/demand imbalance within a market, the higher the degree of inflation protection

So, what are the implications for investors? The above analysis suggests that real estate is a good way to bet on the cycle not necessarily on insuring against inflation. Assuming a property cycle of say, 5 to 10- years was going to be characterised by higher inflation, the benefits of property allocations become more apparent.

Watch this space. INREV is planning to launch series of short papers and articles reflecting on the most relevant industry issues and topics, where the topic of inflation will be explored in more detail.

This article was written by Vanessa Muscarà, Europa Capital Partners LLP