Shifting trends set to redefine Europe’s real estate landscape in 2025

Key findings from the 2025 Investment Intentions Survey

In 2025, the European real estate landscape is set to undergo significant transformation, driven by evolving investor preferences that point to new opportunities and changing priorities. This year’s Investment Intentions Survey uncovers many intriguing trends, with specific countries and sectors emerging as focal points. Let’s take a closer look at the key insights shaping the European market this year.

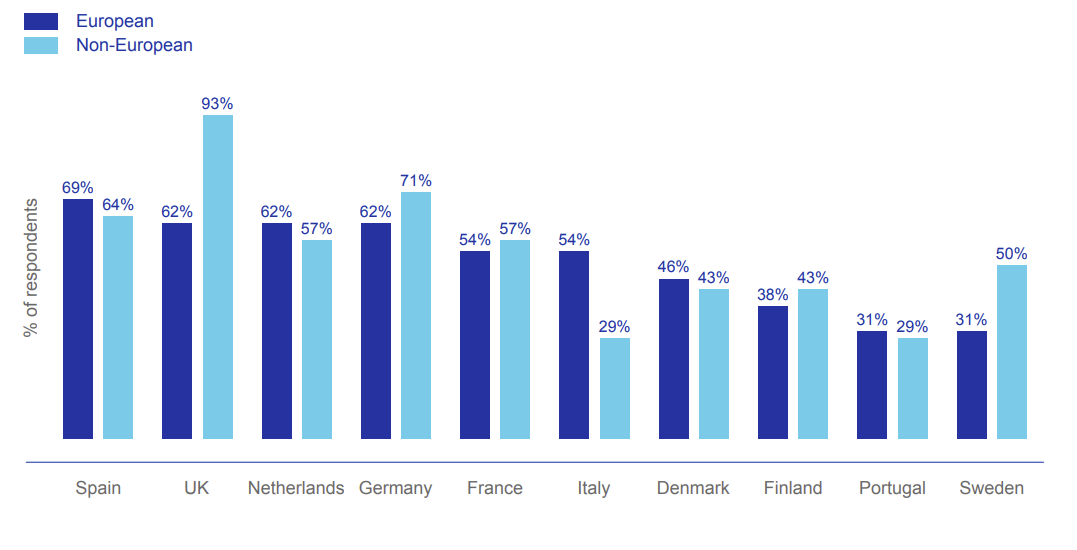

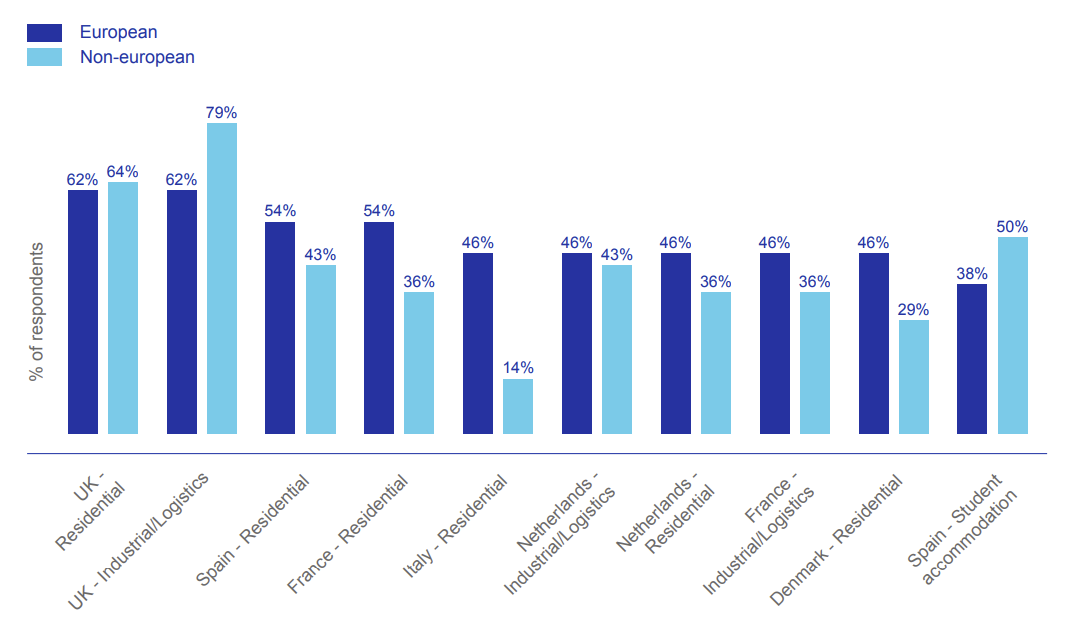

For the first time since the survey's inception, Spain has ascended to become the preferred location among European investors, capturing a remarkable 69% of respondent’s preferences. This marks a huge shift, positioning Spain at the forefront of European investment intentions among European investors. Madrid and Barcelona lead the way, with their industrial/logistics and living sectors particularly favoured by investors. Additionally, Spain’s student accommodation sector debuts in the rankings, further diversifying the country’s appeal (figure 2). Spain’s long-anticipated economic rebound following the COVID-19 pandemic appears to be driving this change. With GDP growth surpassing the eurozone average and unemployment at its lowest point since 2008, the country is drawing significant interest from investors both within and outside of Europe.

Figure 1: Europe’s top preferred destinations in 2025, by investor domicile

The United Kingdom continues to maintain a dominant position, with its residential sector joining industrial/logistics as the top country-sector preference this year. While industrial/logistics led the way last year, this dual-sector dominance highlights the UK’s resilience and adaptability. Furthermore, the UK retains an exceptional level of interest from non-European investors, with a staggering 93% preference - the highest among all locations and an increase from the 85% recorded last year.

Figure 2: Europe’s top preferred country/sector combinations in 2025

In contrast to other top countries, France paints a mixed picture in 2025. While preference from non-European investors has seen a slight increase (from 54% the previous year to 57% this year), interest from European investors has experienced a significant decline, dropping from 72% to 54% this year. Despite this, Paris remains a key destination for its industrial/logistics and residential markets, ranking in the top 10 preferred country/sector combinations (figure 2). Germany has notably retained consistent interest from European investors (62%) and non-European investors (71%), even amidst recent political challenges and slower economic growth.

Primary locations aside, several secondary markets are also drawing increased attention from investors. Italy, Denmark, Finland, Portugal, and Sweden have emerged as notable destinations as investors try to diversify their portfolios. These markets offer promising opportunities across sectors, further underscoring the dynamic nature of European real estate.

This year’s survey introduces several new additions to the country-sector preferences. Denmark, Spain, Italy, and the Netherlands all see their residential markets debut on the list this year. As mentioned earlier, Spain’s student accommodation sector also makes a notable entry. These developments highlight a growing appetite and focus on emerging asset classes.

Industrial/logistics and residential sectors remain at the forefront of investment intentions, continuing their standout preferences from last year. These sectors are particularly favoured in key cities such as Madrid, Barcelona, and Paris, reaffirming their importance in Europe’s evolving real estate landscape.

To conclude, the 2025 edition of the INREV Investment Intentions Survey offers a nuanced and dynamic view of Europe’s real estate market. Spain’s rise to prominence, the growing appeal of secondary markets, and the enduring strength of industrial/logistics and residential sectors underscore the continent’s adaptability and appeal. As investors navigate this changing terrain, strategic insights and forward-thinking approaches will be essential to unlocking the opportunities that lie ahead in Europe’s vibrant real estate landscape.