On This Page:

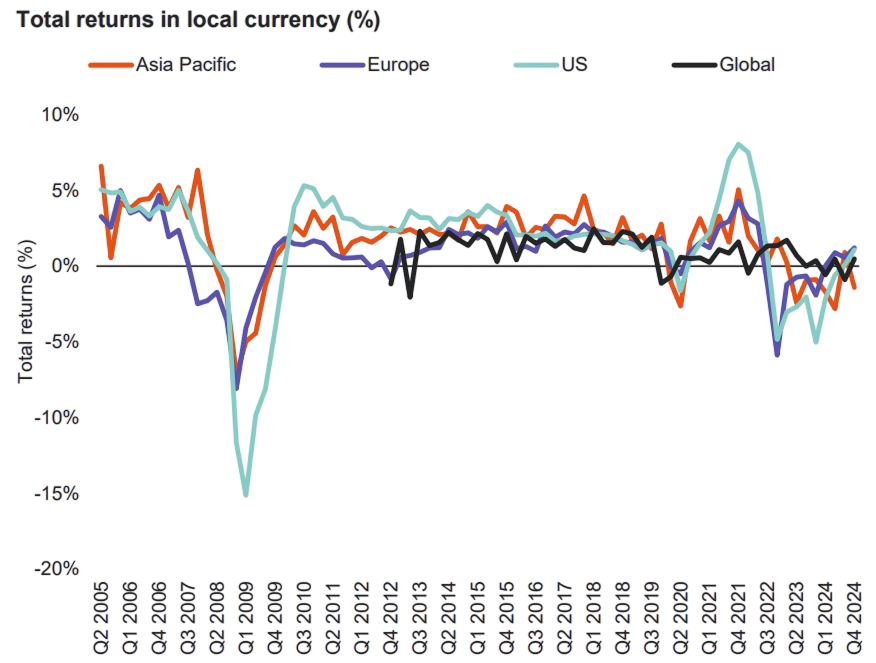

Global Real Estate recorded strongest performance since Q2 2022

- European-focused funds’ performance delivered a total return of 1.21%, the best performance from the region since Q2 2022. At 2.68%, the one-year return turned positive and outperformed the other regions.

- US funds’ performance improved the most and was up by 99 bps, posting a total return of 1.08%. The one-year annualized total return stands at -1.58%. The performance of Asia Pacific funds slid back to negative territory this quarter, delivering a total return of -1.41%.

- The one-year GREFI All Funds Index total return improved from a -4.38% in Q3 to -0.42%. Performance over the longer-term time frame of five years remains positive.

Data collection

The GREFI is built on the data contributed by our members, making it a critical benchmark for the non-listed real estate industry. By sharing your performance data, you play a key role in strengthening market transparency and enhancing the accuracy of our indices.

ANREV, INREV and NCREIF collect data directly from managers in accordance with respective organisation’s data collection practices.

- Asia Pacific data are collected as part of the ANREV Quarterly Index.

- European data are collected as part of the INREV Quarterly Index.

- US data are collected as part of the NCREIF ODCE and NCREIF Open End Funds indices.

Data on global strategy funds are collected in addition to the above-mentioned indices by all organisations.

How to provide data

For each fund, click on "+Add financial period data", provide the required information for the quarter and sign off the data once you are satisfied with its accuracy. Eligible vehicles may be included in the INREV Vehicle Universe, INREV Index, German Vehicles Index, European ODCE Index or INREV IRR Index.

Data validation

Data validation is carried out in a three-step process:

- Systems based validation – the system uses rules-based algorithm to validate data

- Member approval – the member needs to approve information before submission to INREV

- INREV verification – the INREV team verifies information before inclusion to the database

Data confidentiality

INREV will not disclose or share any fund level data provided by any company without the explicit approval of that company.

INREV will only use data provided by any company in a composite where the vehicle and manager are not identifiable.

For any questions or updates, contact research@inrev.org.

General Questions

What is the GREFI Quarterly Index?

The Global Real Estate Fund Index is a fund level index which covers the performance of the global institutional non-listed real estate funds taking part in the index.

Do you have to be a member of either of the partner organisation to be part of the index?

To contribute data to ANREV or INREV you do not need to be a member of either organisation. To contribute data to NCREIF, you need to be a member of NCREIF.

The GREFI publication is only available to members of ANREV, INREV or NCREIF and is accessible via the respective organisation’s website.

Can we see the individual fund performance data available in your platform?

No, performance data is only available in aggregate format. Individual fund performance data is never disclosed and is not accessible by any external party.

How can we join the Global Real Estate Fund Index?

To join the ANREV Index please contact Daisy Huang

To join the INREV Index please contact Bert Teuben

To join the NCREIF Indices please contact Dan Dierking

Index specifications

What are the criteria for GREFI inclusion?

The INREV Index includes the following assets:

- All funds included in the ANREV Quarterly Index – core, value added and opportunity.

- All funds included in the INREV Quarterly Index – core and value added.

- US core funds – NCREIF Fund Index Open End Diversified Core Equity, NFI – ODCE.

- US non-core funds – NCREIF Fund Index Open End, NFI – OE

Are US closed end funds (CEVA funds) included in the Index?

US closed end funds (CEVA funds) are included in the index from Q1 2010 to Q2 2018 performance. From Q3 2018 onwards, CEVA funds are not included in the GREFI.

Does this index include global strategy funds?

Yes, the Global Real Estate Fund Index includes global strategy funds.

Is the index frozen or unfrozen?

The Global Real Estate Fund Index is unfrozen, which means that historical data can change with future updates.

Can this index be used for derivatives?

The INREV Index cannot be used for derivatives, due to the Benchmarks Regulation (BMR) which entered into effect on 1 January 2018.

What type of data are the index results based on?

The Index results are based on fund level data that is provided to INREV, ANREV and NCREIF directly by fund managers.

The Quarterly Index includes only quarterly valued funds.

What happens when a member stops contributing data, would their fund data remain in the index?

When a member stops contributing their data to the Index, this data will remain in the Index ending at the last date of contribution; historical data will be kept in the index to ensure continuity.

Is the index equally weighted or value weighted?

The Global Real Estate Fund Index is value weighted, meaning that larger funds have a bigger impact on the performance of the index.

What is the frequency of data reported in this index?

The Global Real Estate Fund Index includes funds that are reported on a quarterly basis.

What are the confidentiality rules for this index?

The performance for any index or sub-index is reported only when the sample includes at least 3 funds from 3 different managers.

What is done regarding currency conversion when calculating returns?

To calculate aggregate returns, a local currency methodology is used. This means that all funds level indices do not take currency fluctuations into account. To remove the effect of currency fluctuations, the quarterly figures that are reported in currencies other than the USD are converted using the exchange rate of the first day of the quarter.

Do partner organisations collect historical data?

All partner organisation encourage the provision of full history of participating funds.

How is data collected?

ANREV, INREV and NCREIF collect data directly from managers in accordance to respective organisation’s data collection practices.

- Fund managers with a fund investing in APAC, please contact Daisy Huang

- Fund managers with a fund investing in Europe, please contact Bert Teuben

- Fund managers with a fund investing in US, please contact Dan Dierking

- Fund managers with a global strategy fund can contact the partner organisation of the fund domicile.

When should we provide and update the data?

Quarterly data collection starts immediately after a quarter has ended. Please visit the partner organisations’ website for more information on deadlines.

When was the Index launched and when does the data date back up to?

The Global Real Estate Fund Index was launched in 2014 and is now published 12 weeks after quarter end. The GREFI is an unfrozen index which means that historical data can change with future updates. The history of GREFI starts at Q1 2005.

What currency is used in GREFI publication?

The underlying data for the Global Real Estate Fund Index are in local currency. Aggregation of indices is done by converting the reporting period data into USD using the exchange rate of the first day of the period. This approach eliminates the currency movement impact on the returns for the period.

What currency is required for data submission?

Financial data for the funds need to be reported in the reporting currency of the fund.

Does GREFI provide a breakdown by currencies?

The Global Real Estate Fund Index provides breakdowns by regional indices, style and structure but does not provide a breakdown by currencies. Further additions to the GREFI will be rolled out as part of the index development.

Latest publications and downloads

Global Real Estate Fund Index (GREFI) Quarterly

Last updated on 20 Mar 2025

The Global Real Estate Fund Index (GREFI) is jointly produced by INREV, ANREV and NCREIF and measures the performance of non-listed real estate vehicles on a global scale.

Please send feedback to bert.teuben@inrev.org, daisy.huang@anrev.org, or ddierking@ncreif.org

The GREFI is an index showing the performance of non-listed real estate funds on a global scale. The GREFI is updated on a quarterly basis and is published 12 weeks following the quarter end.

The aims of the GREFI are to improve transparency of real estate as an asset class and to help our members make better informed investment decisions. As an industry, it is vital that we work towards being able to make robust global and intra-regional comparisons.

This initiative represents the integration of three member-driven non-profit organisations to meet the data collection and information needs of their expanding global activities, and to serve as the basis for further collaboration in the future.

INREV Index Guide

Last updated on 18 Mar 2025

This guide provides a detailed overview of INREV’s suite of indices and their specific characteristics.