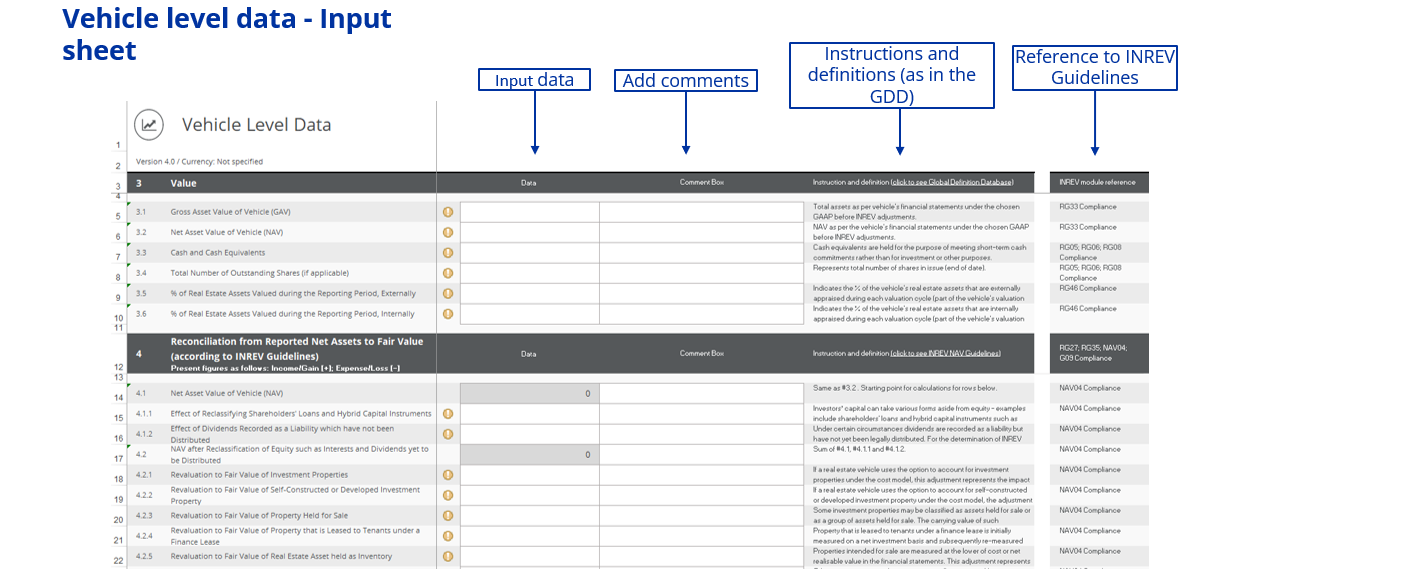

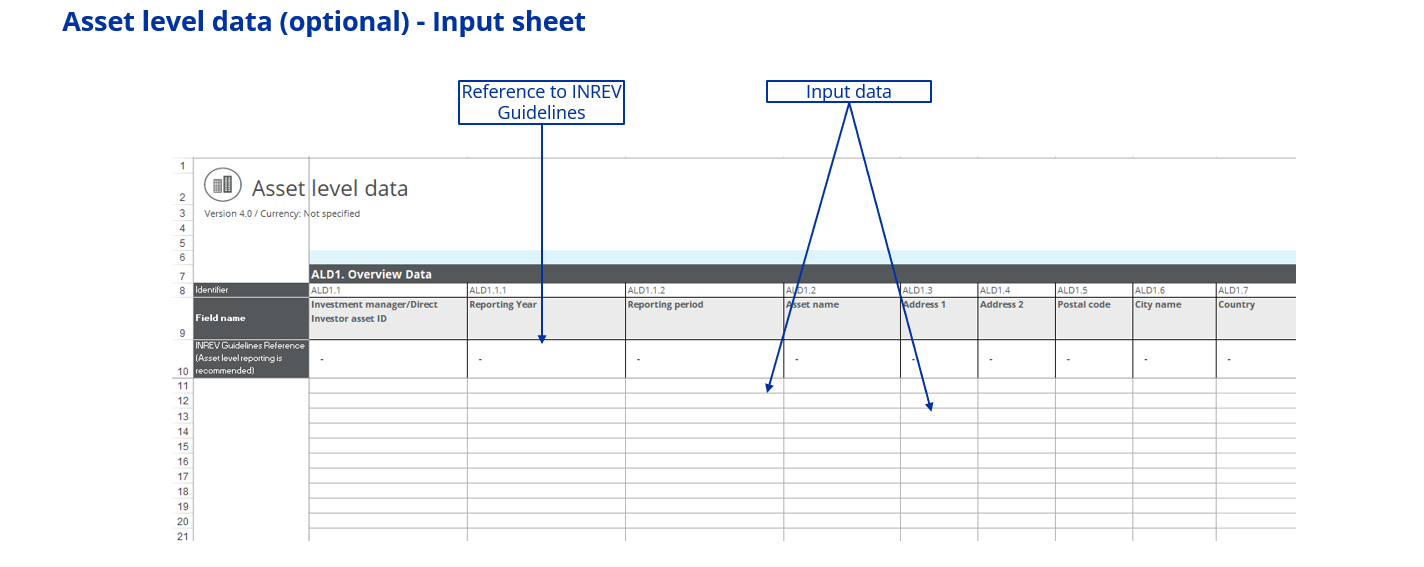

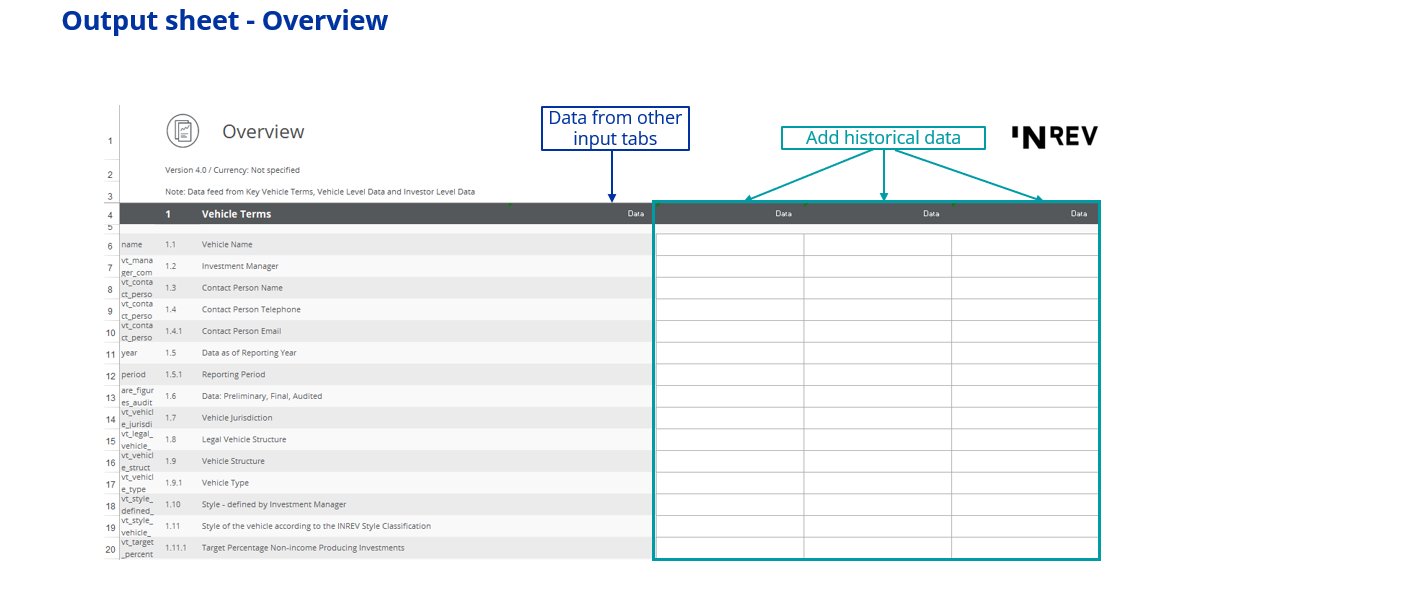

The INREV SDDS is a template designed to standardise the main quantitative components of reporting data to investors, while providing more consistency and comparability.

The most recent update to the sheet was made in November 2023, establishing the INREV SDDS 4.0.

![]()