The challenge of a Pandemic

Nick Westoby, Commercial Fund Manager, Octopus Real Estate

IQ recently caught up with Nick Westoby, who has been a fund manager at Octopus Real Estate since 2017, about the challenges of managing debt funds in the midst of Covid-19 and how he sees INREV helping to take the debt funds industry to the next level.

Like almost everyone involved in European real estate investment, Octopus Real Estate has found the market conditions thrown up by Covid-19 challenging. ‘No one expected to be operating in a pandemic,’ says Westoby, ‘so this is totally uncharted territory for us and the rest of the industry. At Octopus, we are now regularly testing scenarios for every single loan that we hold, putting each into a high, mid or low risk category, which means modelling the potential change in value from peak to trough and assessing the security of the asset.

Yields on commercial property were already at a low level before the onset of the pandemic, so an adjustment was on the cards, but Covid-19 has started to crystallise some of these risks.’

No one expected to be operating in a pandemic

However, extreme market events are not new to the management at Octopus Real Estate, a number of whom cut their teeth during the global finance crisis (GFC).

Westoby, who has worked in the real estate debt business across the UK and Europe since 2008 and leads the investment debt product within Octopus Real Estate’s commercial lending team, comments that, ‘this experience, combined with the fact that we have a number of seasoned real estate professionals on the team, is helping us find ways to work with our borrowers through the current crisis. In response to the market conditions we have listened to borrowers and agreed some loan extensions where necessary. This has allowed them time to complete their plans, which may have been delayed due to Covid-19. We also provided some deferrals of interest to our borrowers in the spring, when their tenants faced severe cashflow problems – but we are working with borrowers and are comfortable that they are on that right trajectory. In this respect we’ve benefitted from our bespoke lending model, which means we have close working relationships with them.’

In this respect we’ve benefitted from our bespoke lending model, which means we have close working relationships with them

In fact, Octopus’s lending focuses mainly on the smaller and medium-sized end of the loan spectrum. At time of writing, Octopus Real Estate has lent over £4.8bn of debt across 3,750 loans since inception. Loan sizes range between £100,000 to £50 million and cover most parts of the residential, commercial and development sectors in the UK. ‘Our sector profile has also stood us in good stead through the pandemic,’ continues Westoby, ‘not just due to the wide range of occupational tenants across multiple sectors, but also from our relatively small exposure to the retail and hospitality sectors, which have been hit hardest by Covid-induced restrictions on movement.’

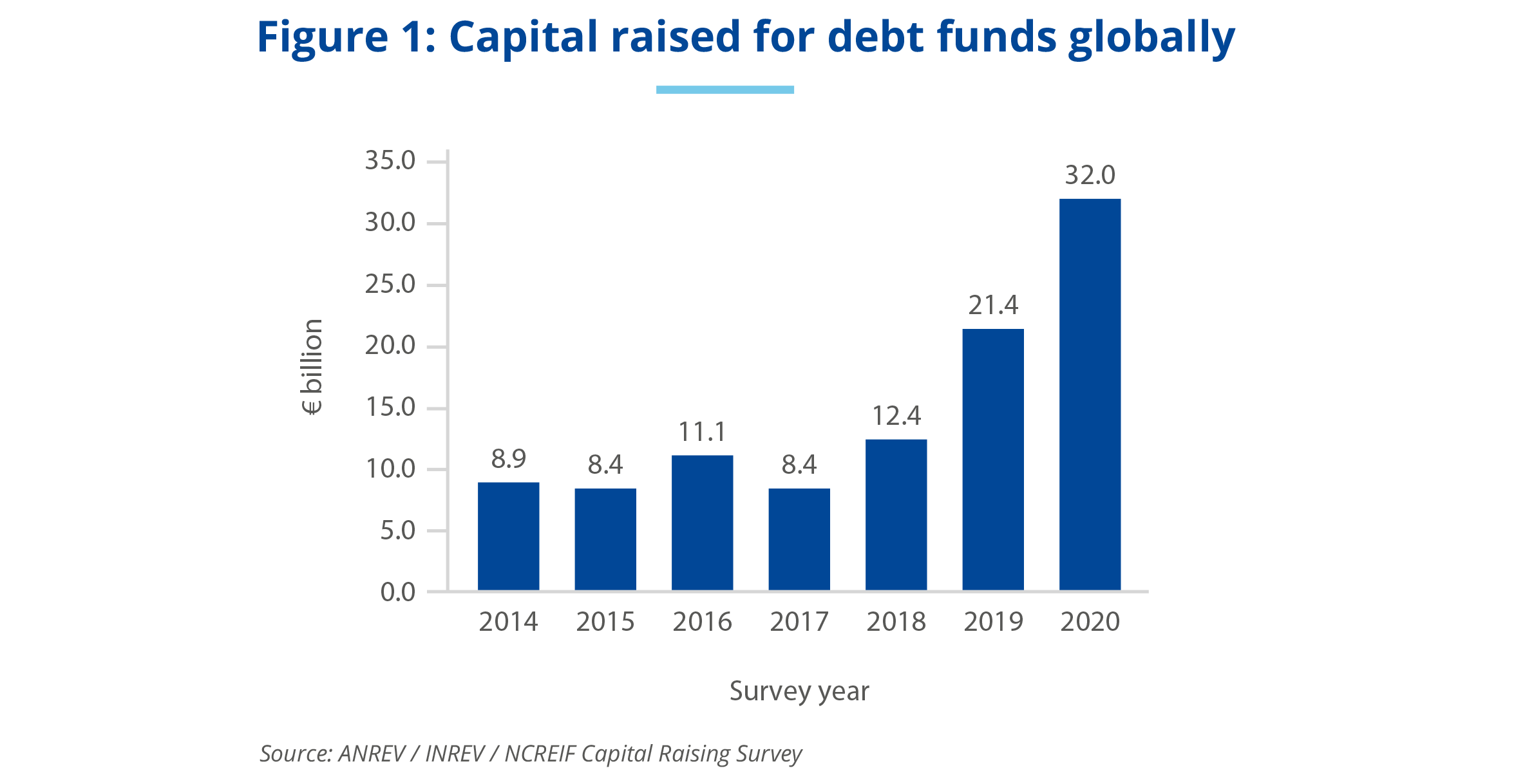

For all the current market turbulence, Octopus Real Estate remains committed to supporting the real estate debt market into the future. ‘We have a good mix of pure real estate and debt finance experience here and debt funds fit well into our Octopus Group model of supporting institutional investors across a range of industries – these now include renewables and venture capital, as well as real estate. The latest Cass Commercial Real Estate Lending survey reported that 27% of UK real estate debt comes from non-bank lenders, and I see no reason why that proportion shouldn’t keep on growing, given the appetite of investing institutions for income-producing assets in the current low-yield environment.’

For instance, the Due Diligence Questionnaire for debt funds can really help investors when choosing which vehicle to invest in – making sure they ask the right questions, not just about the sectors and regions the fund is targeting, but also its debt strategy

Westoby also believes there are big gains to be made from improving market transparency and information standards, an area where INREV has a key role to play. ‘The INREV Debt Funds Universe has been an important first step in allowing investors to compare the sizes and strategies of the funds that are out there,’ he says, ‘but there is still big potential for expanding its coverage. INREV has been actively reaching out to all debt fund managers asking for their participation, so I’d recommend any debt fund managers who don’t yet contribute to go ahead and do so.’

There are big gains to be made from improving market transparency and information standards, an area where INREV has a key role to play

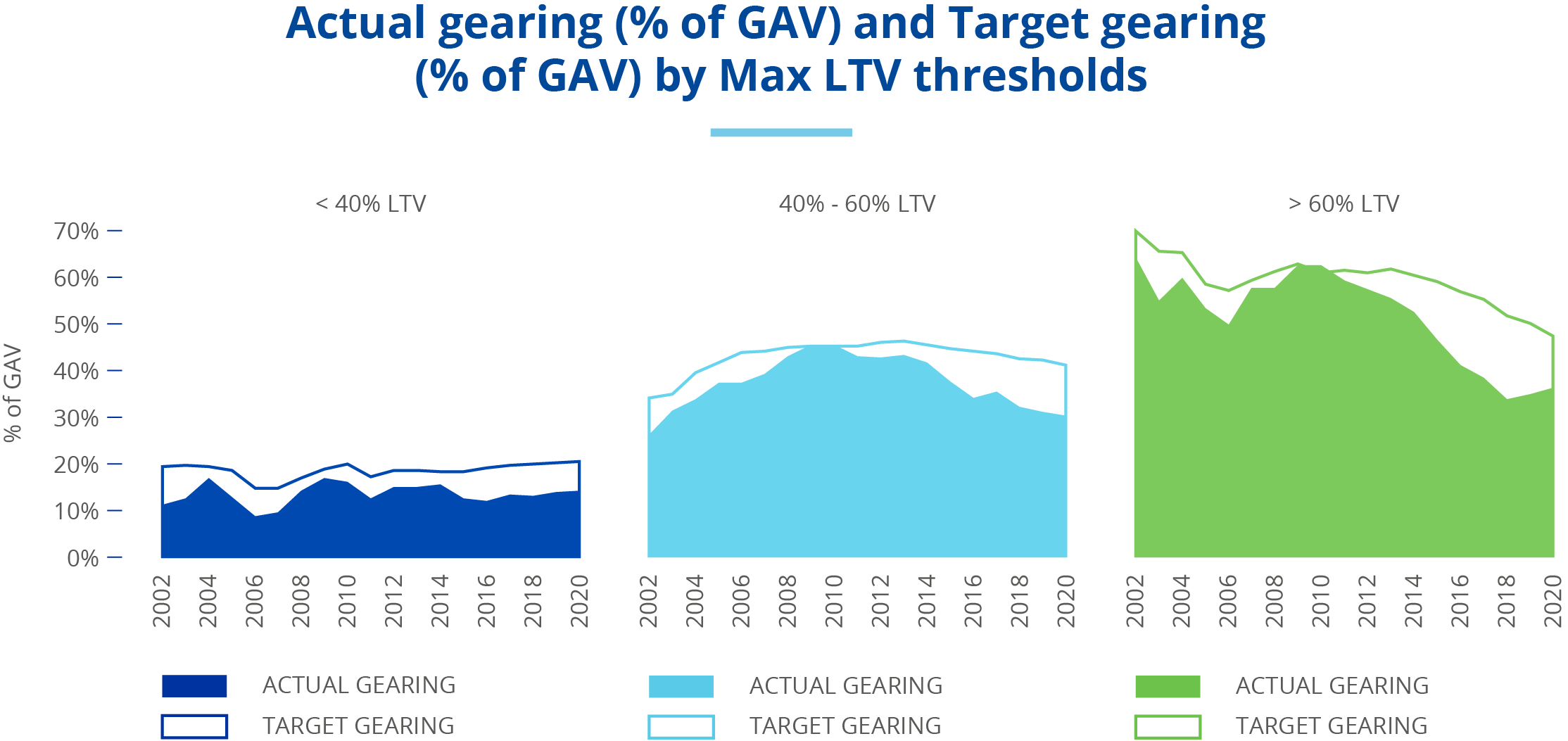

‘I’ve also been impressed by INREV’s efforts to improve best practice in the sector,’ he concludes. ‘For instance, the Due Diligence Questionnaire for debt funds can really help investors when choosing which vehicle to invest in – making sure they ask the right questions, not just about the sectors and regions the fund is targeting, but also its debt strategy. What are the LTV limits of the various segments of the portfolio? This is crucial to get a clear idea of overall risk. The DDQ is one area where INREV has asked for members’ views, and we’ve been very happy to assist. Working together in this way will help take the debt fund market to the next level.’

If you’d like to contribute your Debt Fund to the Debt Fund Universe, contact Oscar Fusco

If you’d like to contribute to the Debt Vehicle DDQ Consultation, contact Bahar Celik