A day to remember

The INREV Asset Level Index takes off

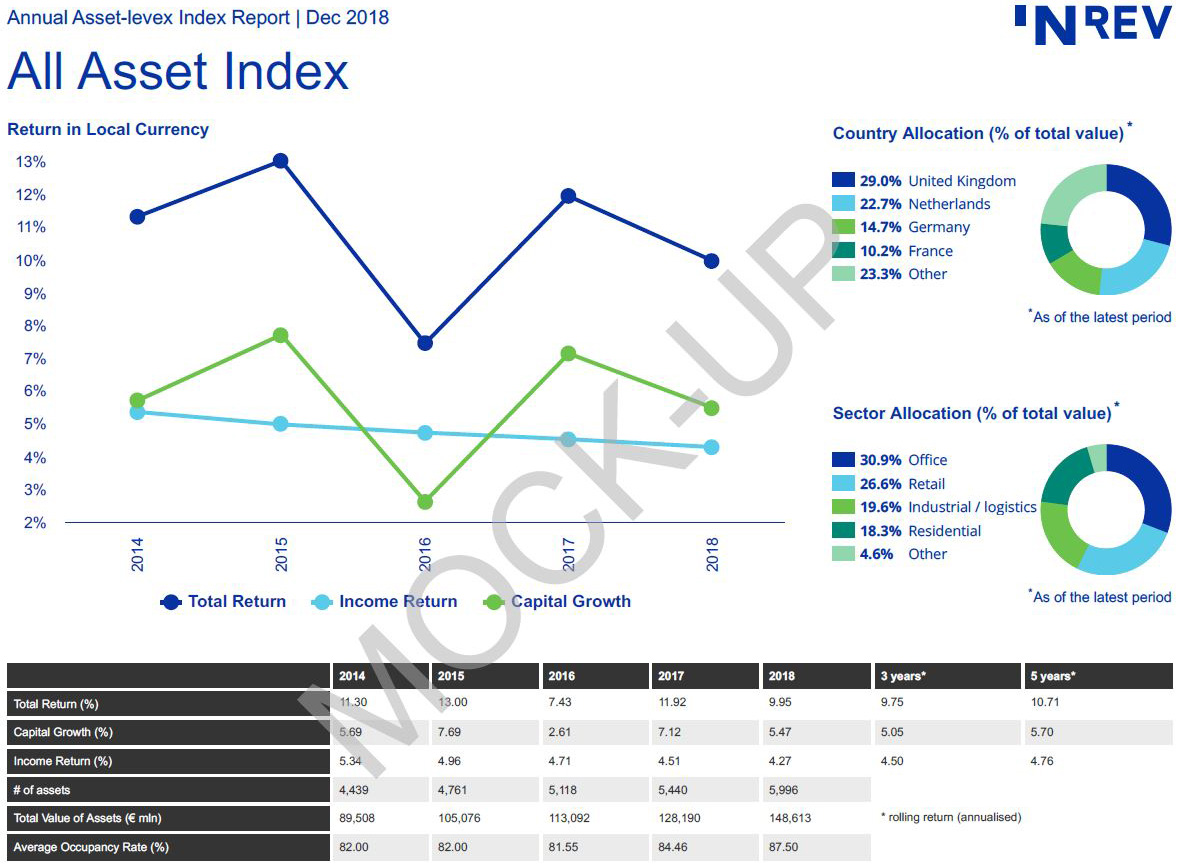

On April 2, 2019, the INREV Asset Level Index was revealed to the European real estate investment industry.

The Asset Level Index deserves a fanfare. In its first incarnation, the index covers more than 7,000 individual assets from across the European region and boasts a total value of over €140 billion. Perhaps most impressively, 32 organisations – 29 managers and 3 investors – are participating in the index, among them some of the biggest names in European real estate investment. The index would not have happened without the support and efforts of these Founding Members.

So the index is based on a solid quantum of data, but that’s not all. The assets in the sample are well spread across the continent and all the main commercial sectors are covered, giving a strong representation of the whole market. And crucially, the launch index already has five years of historical quarterly data as a foundation.

‘We were attracted by the opportunity to help develop the Asset Level Index with INREV given their position as a pan-European industry association – the quality and familiarity of the partner was an important factor for us.’ Simon Nelson, Prologis

TAKING CONTROL

From the start, the idea of producing an Asset Level Index was driven by the INREV membership. Many wanted to see a non-profit making index with products and systems that INREV members could control and benefit from. Add to this INREV’s 15 years of experience in collecting and processing data – combined with the potential to expand globally in collaboration with NCREIF and ANREV – and the plan made perfect sense. Building an index from scratch also let INREV use new data security technology and make the data collection and validation processes as painless as possible.

‘The key benefits of the index will be transparency, comparability and consistency. By making headline data publicly available, it will contribute to the globalisation of standards and help to drive the cost of transparency down, which is a key factor in the development of the real estate industry.’ Matthias Pilz, Allianz Real Estate

The Asset Level Index journey began in 2015, when INREV members first started to call for it. Since then eight working groups have laboured tirelessly to test the feasibility of the concept and to develop the technical infrastructure for the index, including standard methods for calculating the performance results.

WE'VE ONLY JUST BEGUN

Now that the INREV Asset Level Index has been successfully launched, can we all sit back and relax? Far from it. While the Founders’ index comprises an impressive €140 billion of assets across the European continent, this is just the tip of the iceberg. If every vehicle manager participates, INREV estimates there is the potential to grow the index to €500 - 700 billion within five years and has set a target of matching the INREV Fund Index size of €240 billion by 2021. This level of growth will mean many more managers and investors need to join the 32 Founder Members. But it will allow far more to be done with the asset-level data and dramatically improve its value for all those INREV members that participate.

‘Greater granularity gives a better idea of winners and losers. Information at the asset level makes it easier to see what’s working and what’s not working and decreases the information asymmetry between investors and managers.’ Maarten Jennen, PGGM

THE INDEX NEEDS YOU – AND YOU NEED THE INDEX

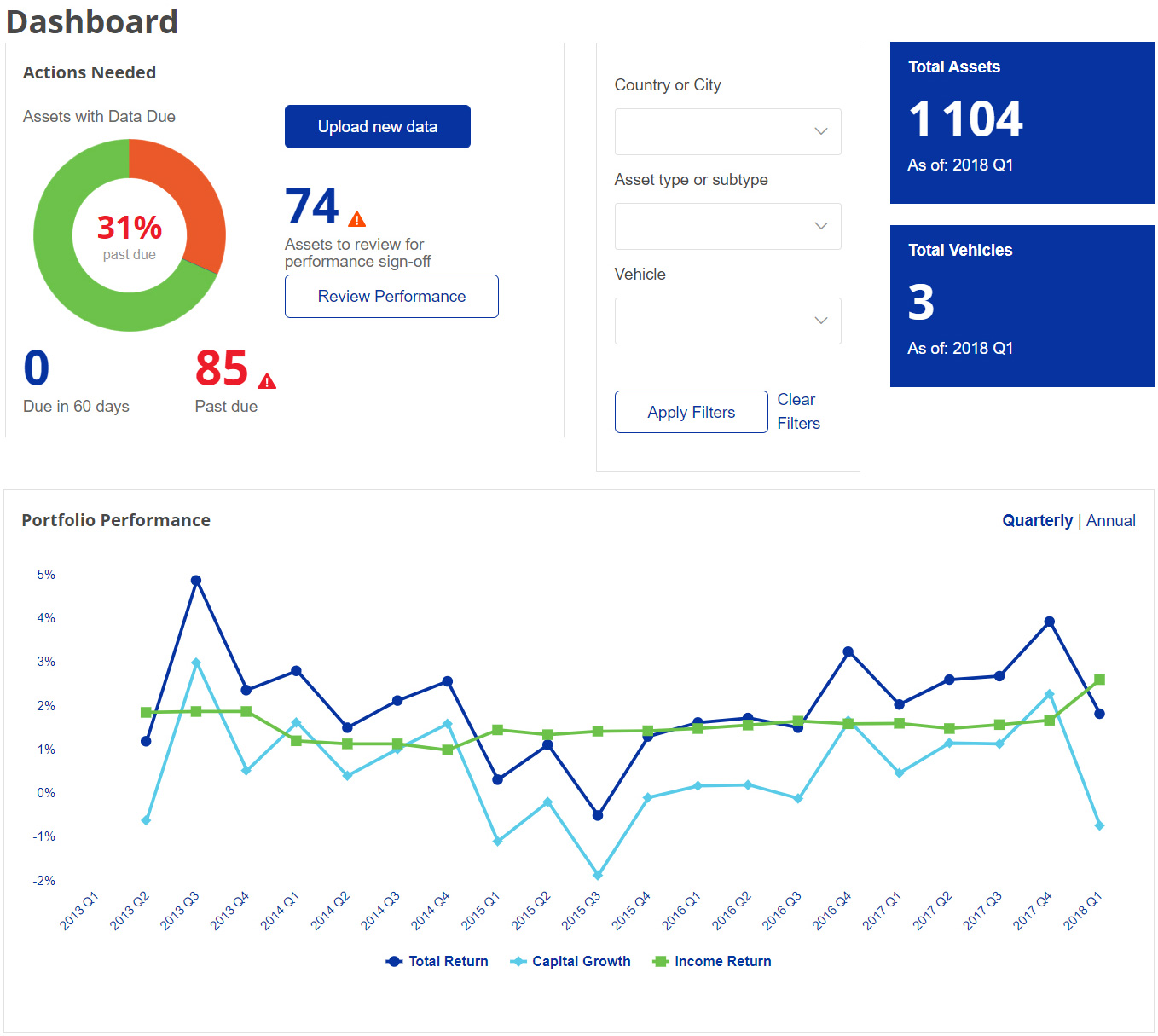

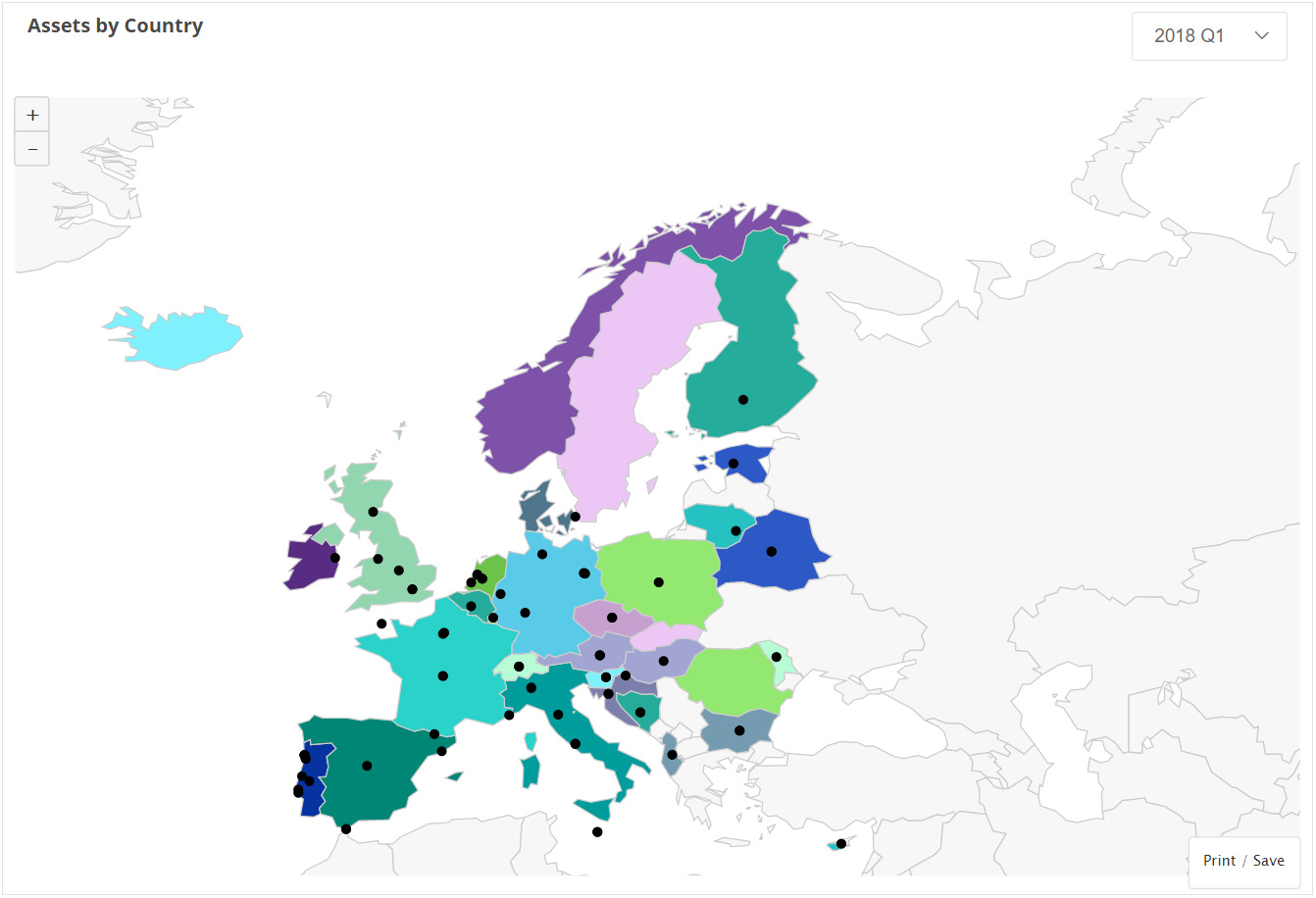

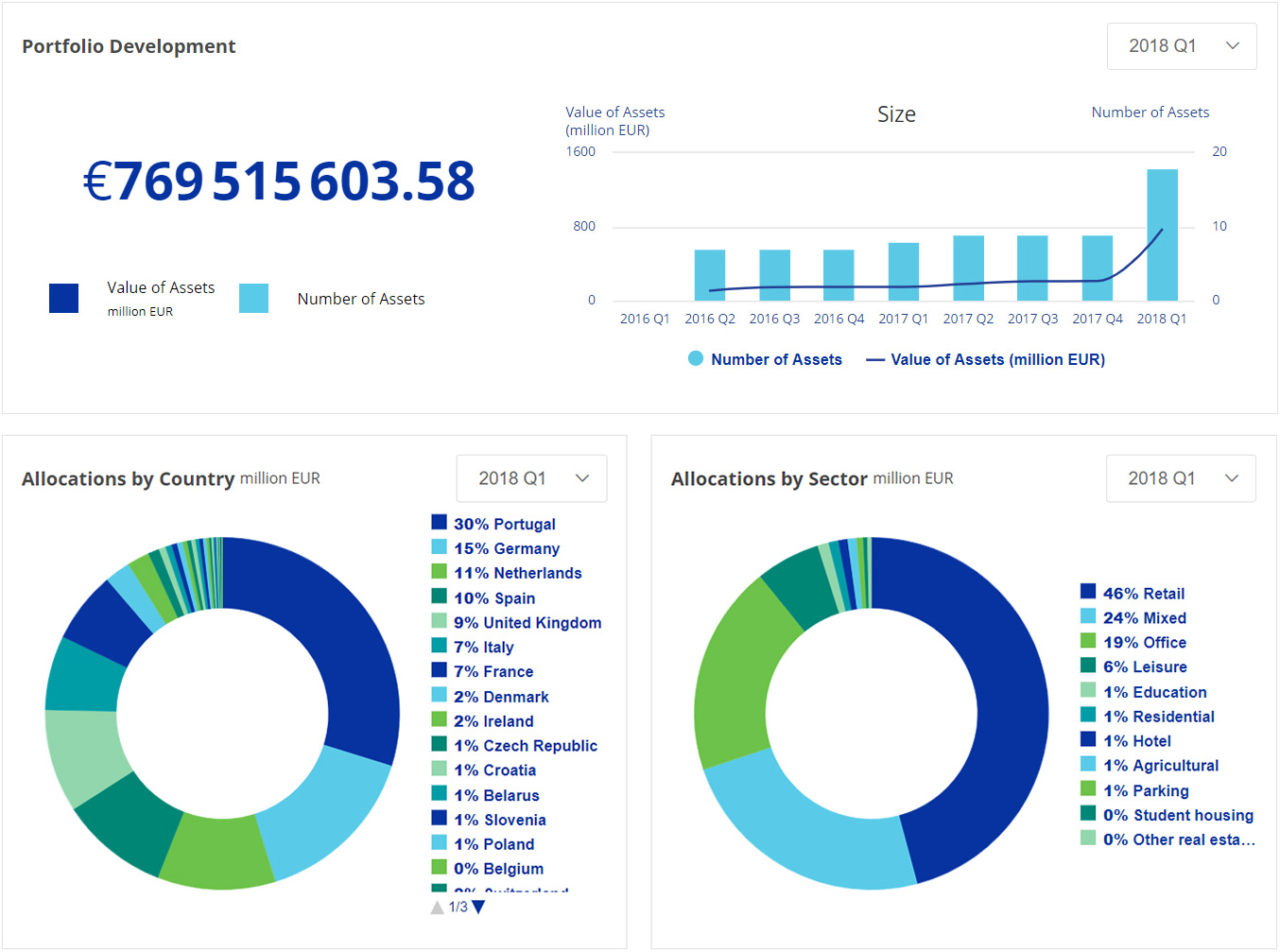

In order to increase the depth of the index data and the level of detail available to participants, it’s essential that participation goes on growing fast. The 32 Founding Members have already taken the plunge, but why should others do the same? In a nutshell, subscription will give you valuable tools to leverage the Asset Level Index data and boost the understanding of your own portfolio. These tools will not only allow you to create your own customised indices, but also give you deeper insights into the drivers of your own vehicle performance.

As an incentive to join the index now, those who do so will gain all the benefits of normal membership, but without having to pay the annual fee of €7,500 – covering technology infrastructure costs – until next year. Subscription gives access to three unique functionalities using a single tool: online market analysis and portfolio analysis, with in-depth measurements and comparisons, together with a data input functionality to ease the collection process. As can be seen from the sample screens in this article, these provide key measures of performance – total, income and capital returns – as well as allocations by sector and region, for both the portfolio and the market.

‘The index will raise more questions that will need answering and that’s good for the industry, but it will be a quantum leap in terms of data availability in many markets because we’re going from a desert to little pockets of oases.’ David Hedalen, Aberdeen Standard Investments

Although highlights of the index results will be seen by all INREV members, we must stress that in-depth market data will only be available to members that support the index by providing their own data.

THE FUTURE’S BRIGHT

It’s very encouraging to see how much support the Asset Level Index has already received across the European industry, and there’s every reason to believe that it will go from strength to strength. For one thing, INREV members will continue to mould the way the index develops and the tools that will make it useful – it will be the industry’s index. A key area of this future collaboration will be in deciding how to link the Asset Level Index with the existing INREV fund level indices, as this should potentially allow for performance attribution and reconciliation in the future.

But the biggest strength of the Asset Level Index is that it’s based on a deep understanding of the real needs of INREV’s members. INREV has an enviable track record of only doing what’s feasible and what makes sense, and the Asset Level Index will be no exception.