Making governance count

INREV’s new Corporate Governance Assessment

INREV’s new Corporate Governance Assessment is set to bring greater transparency to this key aspect of every fund.

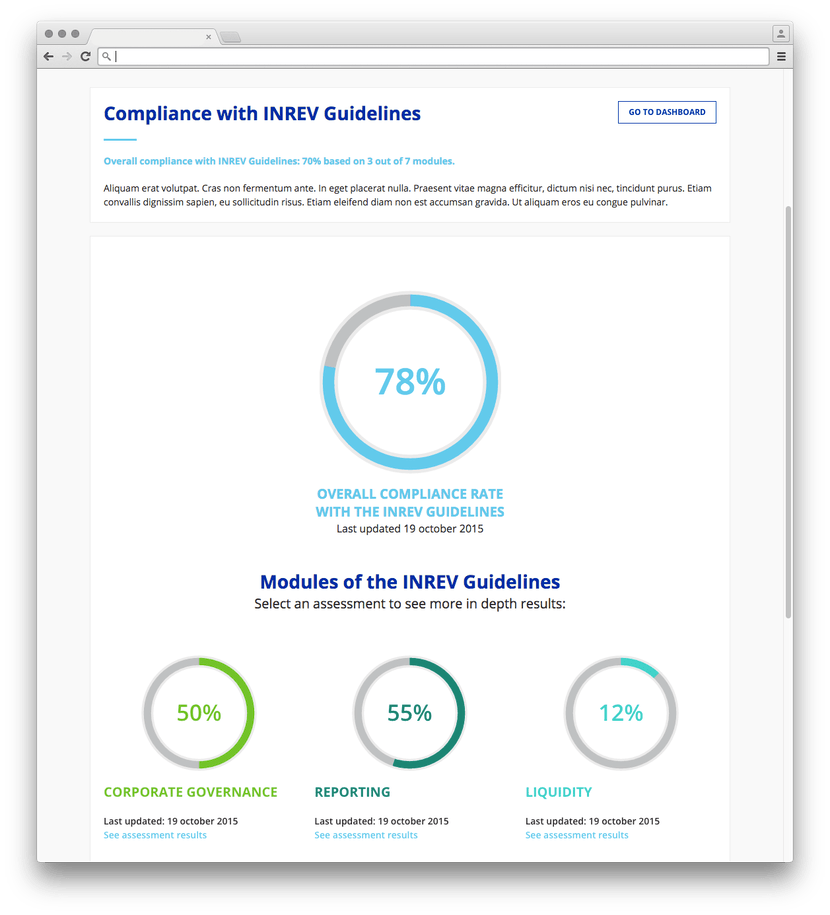

The new INREV Corporate Governance Assessment is now available for members to use on our website. This is the first of the suite of INREV Guidelines Compliance Assessment tools, all of which will be launched over the next few weeks. It will be followed by those for Reporting, INREV NAV, Fee and Expense Metrics, Liquidity and Sustainability Reporting.

The Corporate Governance Assessment aims to bring greater transparency to individual investment vehicles and the nonlisted real estate market as a whole. It will allow investors to make a more informed choice when selecting managers and should help weed out poor governance practices. Managers will be able to compare their levels of governance to industry norms and target areas for improvement.

The tool provides a practical way for fund managers to measure the strength of their governance regimes, by quantifying the level of compliance with the INREV Corporate Governance Guidelines. This information can then be made available to investors and potential investors in their funds.

The tool is intended to be used right through the vehicle’s life cycle, but especially during the set-up phase and at times when new investors can enter. It will help managers by providing a statement of compliance that can be used in the vehicle’s annual corporate governance report to investors, allowing them to show the vehicle’s level of compliance with the industry guidelines. It provides a base reference point for improving the vehicle terms and its reporting framework.

With the new Guidelines Assessment fully established, it will be possible for a manager to see their overall compliance rate with the INREV Guidelines in one overview.

Investors will be able to use the assessments to support their due diligence processes for vehicles and to facilitate a dialogue with managers about corporate governance and reporting issues. The results will act as an internal touchstone for comparing existing and potential investments in vehicles.

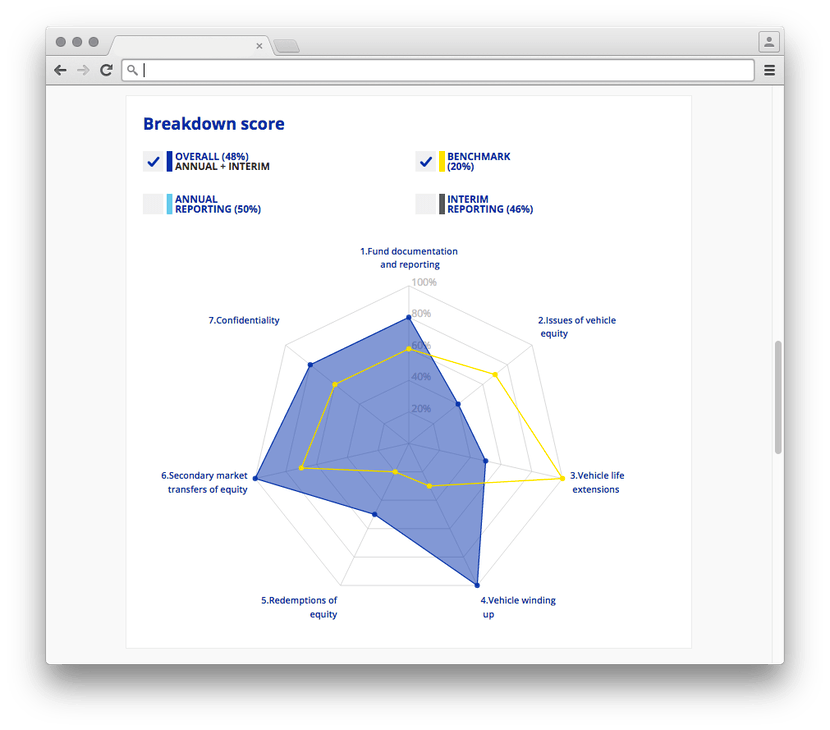

The new tool represents an important step for INREV. It provides a more structured way of measuring compliance with the Guidelines than was previously available. It is now possible to compare compliance levels for different vehicles in a consistent way, and in future this can be set against the market as a whole – once a critical mass of funds have used the tool and agreed that their results can be aggregated for benchmarking purposes.

It should be stressed that the results from using the tool are confidential and only available to the provider – until permission is given for them to be released. This applies both to the detailed questionnaire responses and any aggregated reporting. However, it is very much hoped that fund managers will recognize the benefit of releasing this information to their investors, and also making it available for benchmarking purposes.

Measure the strength of governance regimes by quantifying the level of compliance with the INREV Corporate Governance Module.

It will be also be possible to link a fund’s level of governance with other relevant INREV data – for example on the fund’s compliance with other Guidelines, or with its investment performance.

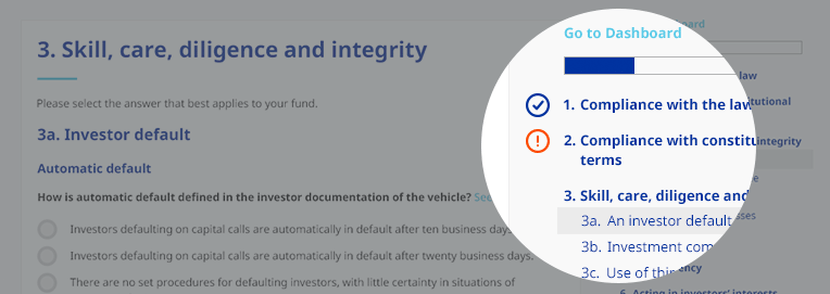

The self-assessment takes the form of an online questionnaire. Users are able to move freely between the various sections of the survey, and can also save their progress and come back later.

Once all modules of the full INREV Guidelines Compliance Assessment are ready, a dashboard will allow fund managers to keep track of all their assessments and results, and to see an overview of all their vehicles under management. It will also provide access to previously exported drafts, as well as the final versions of the results.

With the new Guidelines Assessment fully established, it will be possible for a manager to see their overall compliance rate with the INREV Guidelines in one overview, with the results shown either on a single page or in a more detailed breakdown.

Taken together, the Guidelines and the Self- Assessment should continue to drive a better understanding of the importance of corporate governance for the industry.

Managers will be able to compare their levels of governance to industry norms and target areas for improvement.

MODULES

INREV WEBSITE

Start your assessment.